Xendit’s focus on empowering the MSME sector, including individual traders and social sellers, can be seen through its various innovations. The company released three solutions, two of them aimed for the MSME sector, the Xendit Business Application and the Xendit Online Store.

Xendit’s Founder & CEO, Moses Lo said, this application is here to serve Indonesian business customers who operate their businesses mostly through smartphone rather than laptops. “Through this application, everyone can now easily and securely manage digital payment transactions. In order to support mobility, Xendit customers can issue invoices and accept various payment methods,” he said.

Aside from managing and accepting online payments from buyers, Xendit Bisnis app is also powered by various features. One of them is Order Management, which allows businesses to process all transactions automatically, from ordering, arranging shipments, to recapitulating all purchases.

That way, online business operations can run smoothly and efficiently in terms of time savings. Xendit’s Product Manager, Andri Setiawan said that this application can also store customer contacts, therefore, businesses can easily send invoices.

“The invoice contains billing details along with payment links that will direct consumers to various payment methods chosen by the seller and can be chosen by consumers. The funds will be received by the seller as soon as the payment has been completed,” Andri said.

He continued, the Xendit Bisnis application will continue to add features to make it easier for merchants to transform digitally. Among other things, integrating the Xendit Online Store with applications, managing inventory, checking shipping costs, and ordering logistics services. Xendit Bisnis is now available on the Play Store and App Store.

The second business solution is the Xendit Online Store to make it easier for businesses to set up their own online stores. This feature allows businesses to have a shop with a unique URL in less than five minutes and is equipped with Xendit’s choice of payment method features.

This feature is available for free and can be directly used by individual businesses and MSMEs registered with Xendit, to increase the reach of buyers and strengthen their sales channels, without relying on other e-commerce platforms. To access this, users can navigate to the Dashboard, select “Store” and select “Online Store”

Corporate solution

The third business solution is XenSol (Xendit Solution), a collaboration with Andrew Tani & Co. (ATC). This solution is geared towards large-scale business people who are trying to conduct a comprehensive digital transformation. Companies can use consulting services from ATC and Xendit will support this digital transformation by providing a better digital payment infrastructure. Later, Xendit plans to invite relevant partners and agencies as partners to run the XenSol program in a sustainable manner.

The addition of this new solution is expected to make it easier for all business people with digital access to create an equal competitive environment, so that all businesses can grow well. This target is in line with that carried out by the government to bring more than 30 million MSMEs to go digital by 2025.

Previously, in August 2021, the company launched the Xendit Inventory Sync Tool, a multi-channel technology innovation for managing stock inventory of products sold on online marketplaces, as well as Shopify and Woocommerce sites. This feature makes it easy for business people to monitor and manage the amount of stock in each channel in one neat and integrated dashboard.

In addition to creating its own features, Xendit has also invested in majoo, a SaaS startup that develops omnichannel solutions. It is certain that the two companies will take advantage of each other’s ecosystem to develop solutions for MSMEs, although the plan has not been officially announced.

Overall, Xendit has processed more than 110 million transactions per year with a total volume of more than IDR 142 trillion. Xendit wants to simplify the payment process for all sizes of businesses in Indonesia, the Philippines and Southeast Asia. Xendit enables businesses to receive payments, cash out, disburse payroll, run marketplaces, and more.

SME Digitization

Based on data from the Ministry of Cooperatives and Small and Medium Enterprises, out of 64.2 million MSME units, only 19% of them have entered the digital ecosystem. The government itself targets 30 million MSME units to enter the digital ecosystem by 2024.

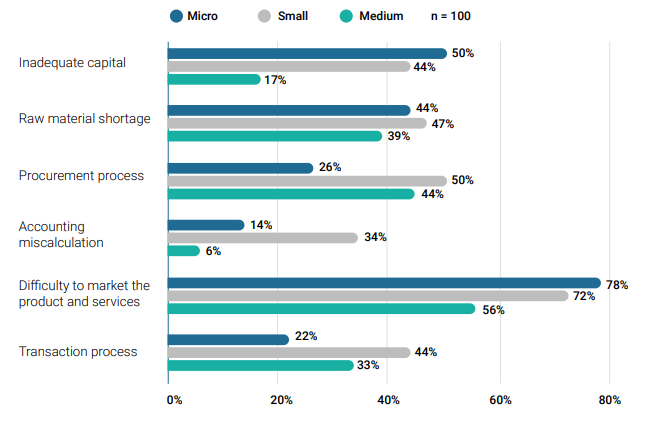

Aside from Xendit, there are many companies that provide a variety of solutions to facilitate SMEs to go digital from various business aspects, fintech, supply chain, logistics, e-commerce, marketing, and others. According to data in the 2021 MSME Empowerment Report published by DSInnovate, there are several basic problems currently experienced by MSME actors in Indonesia, including:

In order to overcome these problems, 83% of MSME players claim to use services from digital startups. From this hypothesis, the founders are passionate about presenting a variety of products with different value propositions. Currently there are dozens of startups that present various types of SaaS in this segment.

–

Original article is in Indonesian, translated by Kristin Siagian