Gojek introduces Go-Sure as its latest service targeting the online insurance industry. It’s still in beta version and available only for selected users. The service provided by PasarPolis online insurance and currently sell travel insurance products.

The possibility is high for Go-Sure to add new variants considering PasarPolis also has other products, such as vehicle insurance and gadget screen. The latest service is to tighten Gojek’s position as a super app.

PasarPolis synergy with Gojek becomes stronger after the series A funding involving Traveloka and Tokopedia last year. They also support gadget insurance for drivers and accidental insurance for all customers, either in Indonesia or other Gojek’s operational countries, Vietnam and Thailand.

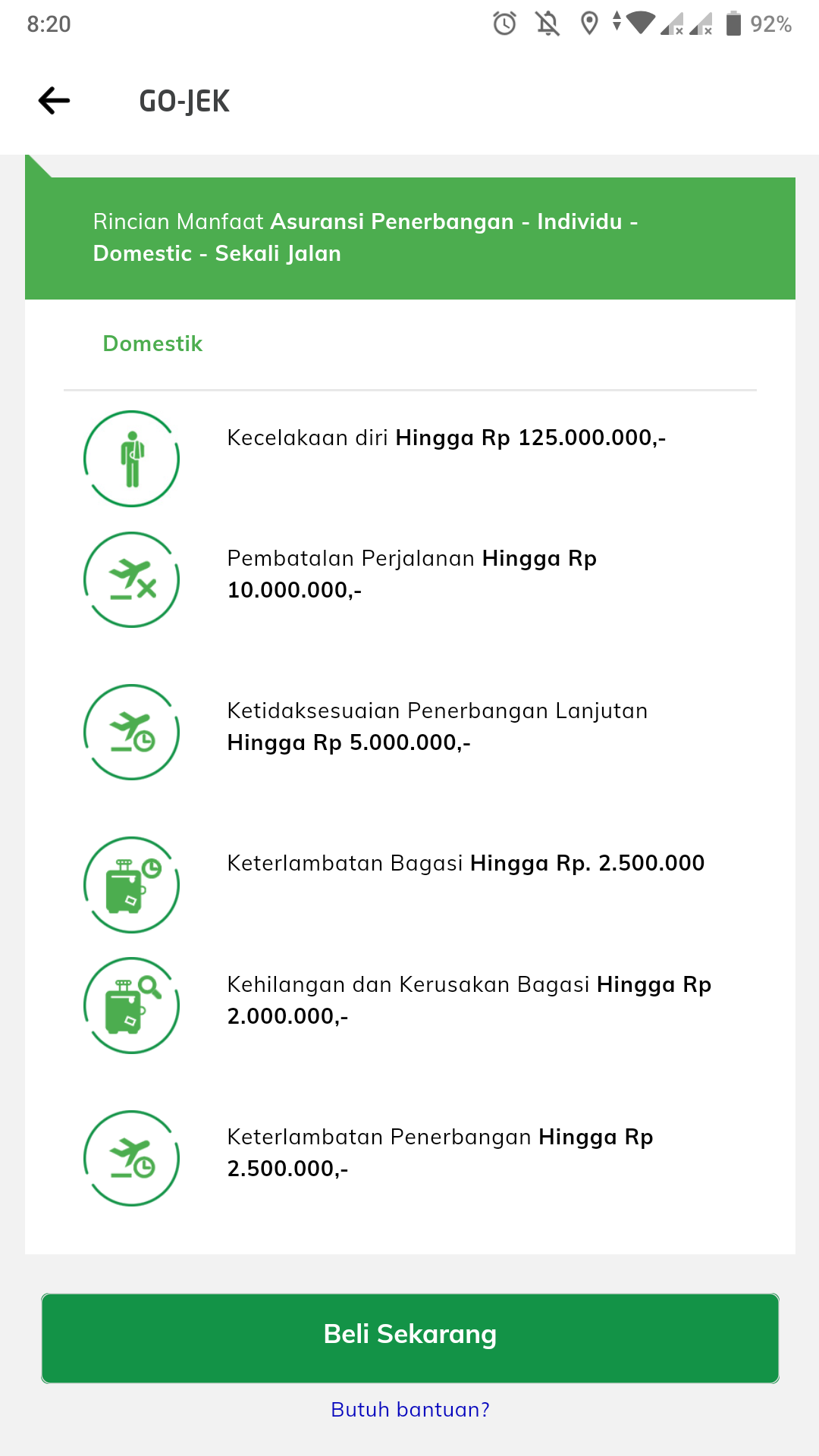

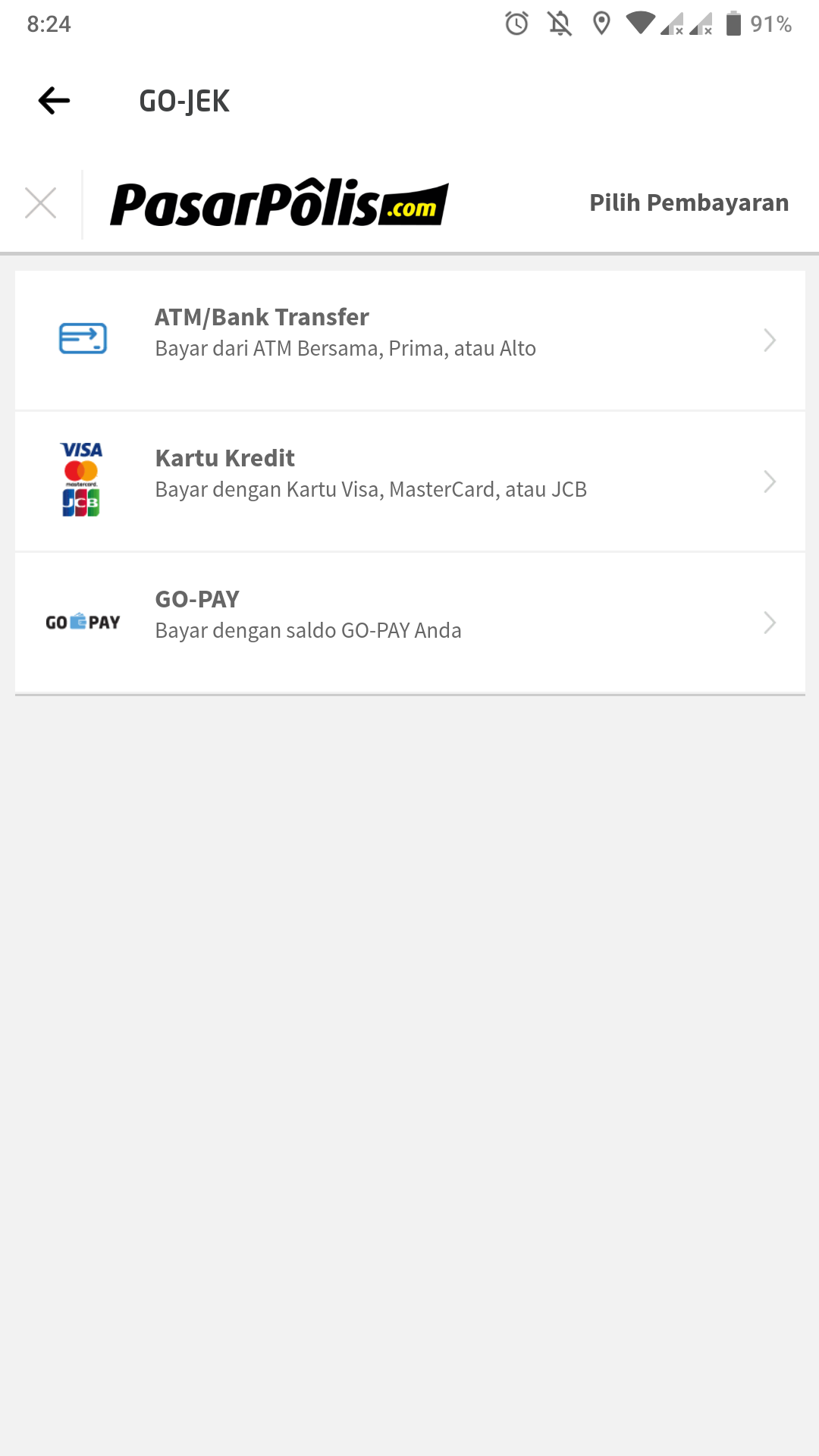

The procedure is quite easy. Users only required to fill the flight type, destination, date, and profile. Payments can be made via bank transfer, credit card, or Go-Pay. It has two options, Rp17,500 or Rp35,000.

PasarPolis also provides instant claim as an added value. By entering the flight number, the system will automatically notify the customers of delay or any other issues. The claim supposed to be faster.

The lack of insurance penetration in Indonesia has become a stuffed cake to be taken seriously. Another unicorn startup, Traveloka, already provide travel insurance in its app, partners with Asuransi Simasnet. They also offer bundling products for each booking with Chubb insurance. Meanwhile, PasarPolis is available in JD.id, PegiPegi, and Citilink.

They also claim to handle more than 100 thousand travel insurance purchasing and hundreds of claims. In the Q4 of 2018, it has sold more than a million insurance policies.

–

Original article is in Indonesian, translated by Kristin Siagian