OVO appointed Jaygan Fu Ponnudurai as the new CEO replacing Jason Thompson as of September 2021. Jaygan was previously OVO’s COO since June 2018, also held various positions at Grab Malaysia and Grab Indonesia.

Regarding this succession, Jaygan has confirmed his new position to the DailySocial.id team.

Both Jaygan and Thompson were former Grab executives before leading OVO. Thompson previously served as GrabPay’s Managing Director before becoming OVO’s number one person. Before Thompson, OVO was led by Adrian Suherman in its early establishment as part of the Lippo group.

After Thompson served as the CEO, Adrian moved as OVO’s President Director, until Karaniya Dharmasaputra arrived to occupy the seat until now. Adrian is currently the President Director of Matahari Putra Prima (MPPA).

In separate occation, at yesterday’s (28/9) press conference, OVO has now entered its 4th year and has transformed from being just an e-money platform to digital financial services. “One of the innovations in the investment area is with Bareksa, a deep integration between e-money and e-investment. This is what I think is the first in Indonesia,” Karaniya said.

In fact, entering its second year, OVO has become the country’s 5th unicorn. It also means the youngest company compared to its peers.

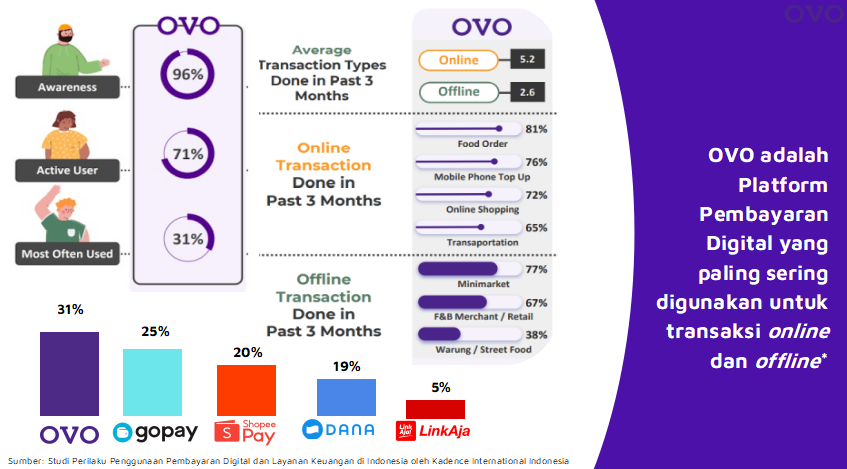

In the midst of fierce competition for digital payment services, he continued, according to research by Kadence International Indonesia, OVO is the most often used digital payment. It is said that OVO has 71% active users and a brand awareness level of up to 96%. It was also revealed that OVO’s user profiles came from the age group of 25-45 years with a composition of 51% male and 49% female.

Some of the reasons for consumers choosing OVO are include accesible with many applications or online merchants, available for bank account transfer, offering many promos and cashbacks, the lowest top-up fees, and used by many online stores and merchants.

The research also revealed that 8 out of 10 OVO users ordered food online and 7 out of 10 users used OVO for offline payment transactions at restaurants.

OVO is now available in more than 430 cities and regencies, with more than 1.2 million merchants from various industries, including MSMEs that have implemented QRIS.

Digital payment app competition

Based on Bank Indonesia’s data, the number of electronic money transactions in 2020 has reached Rp161 trillion with 4.6 billion transaction volumes. The trend continues to increase from year to year, as of August 2021 alone, it has recorded a transaction value of IDR 161 trillion with 3.3 billion transactions.

OVO has a fairly strong position in the market, especially as the main payment service on Tokopedia and Grab. According to the BOKU 2021 report, based on the market share of the total existing players, the ranking is as follow: OVO (38.2%), ShopeePay (15.6%), LinkAja (13.9%), Gopay (13.2 %), and FUND (12,2%).

However, OVO clearly not to be careless, the business dynamics that recently occured have the potential to ‘threaten its position’. With the Gojek-Tokopedia business merger, in particular they also co-founded GoTo Financial which will accommodate all fintech on both platforms. Gojek alone has Gopay and Gopaylater which is OVO’s direct competitor. Recently, its services have started to be integrated into Tokopedia.

It is likewise for Grab, the ride-hailing giant’s intimacy with EMTEK has been getting closer lately. Meanwhile, the technology conglomerate also operates DANA in its line of business. To date, there has been no indication of OVO’s shifting position in Grab; the news spread about merger plan between OVO and DANA.

With another player comes another strategy. ShopeePay is still focused on accommodating its very massive customers, while starting to dive into the O2O realm. Meanwhile LinkAja continues to strengthen its presence as an offline merchants payment– by continuously increasing integration into consumer platforms, including Gojek.

–

Original article is in Indonesian, translated by Kristin Siagian