After around two years of operation, Skye Sab Indonesia mobile money and e-payment platform has gathered 125 thousands users, and 80 percent of them are active ones. To set further milestones, Skye is now targeting Small and Medium Enterprises (SME) to be their loyal users.

Skye aims to ease users doing their transaction online without having to waste their time going and lining up at banks or ATM. To differentiate its services from other similar platforms, Skye provides distinctive features, e.g top up, unlocked SIM card, and social media integration.

Adrian S. Djojorahardjo, Skye Sab’s CEO, stated that in average, the active users transact using Skye four times in a month. However, most of them still use the service to top up their cellphone credit, electricity token, and online game vouchers. In order to enrich the type of transactions that it deals with, the platform plans to invite SMEs to be its active customers.

“We look to develop our own mobile app for SMEs by serving them cheaper, easier, and more real-time based payment services. We partner with handset providers like AccessGo to make it happen. We are also open to other Android-based handset vendors. We offer easy settlement, communities, and other benefits,” Djojorahardjo told DailySocial.

Skye has also prepared a strategy to enter the e-commerce competition. In this regard, Djojorahardjo stated, “We enter big communities and social media. Since our platform is mobile app, we plan to enter every possible platforms, including BlackBerry, Android, and iOS. As for communities, we can provide them a SKYE API once they have their own app. That way, they may have a personal e-wallet, even though the license of e-money remains Skye’s.”

While the strategy looks promising, it still has plenty potential challenges to face. Djojorahardjo stated that the biggest challenge would be educating the public.

“e-money users are still in the education phase, so our strategy would be to supply them with basic knowledge and user experience which are different with mobile banking or internet banking. We award them the loyalty reward for each and every transaction, depending on its type,” he added.

“We also enter to big communities like Rumah Zakat, Multimedia Nusantara University, and Binus University. The challenge is to direct users in the usage of e-money and tell them how to top up and transact. Once they feel that it is easier this way, then they will be our loyal customers. For instance, an online gamer will keep using our services once he tries Skye, as we provide him many facilities, i.e cheaper price, reward points and real-time voucher code which is sent via e-mail and SMS,” he stated.

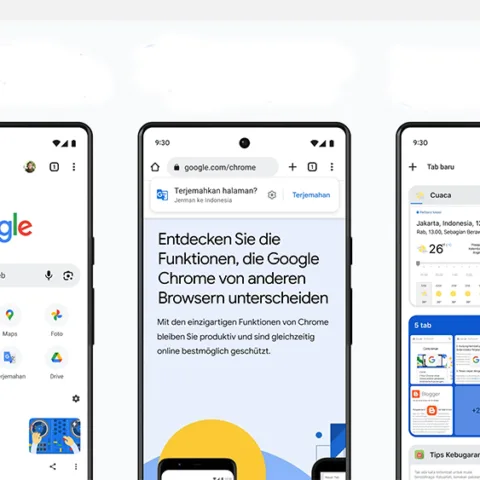

In the meantime, Skye is available for Android and Blackberry. Djojorahardjo stated, “Android dominates, covers 80 percent of our total users. We will soon make Skye available for iOS. Just wait and see.”

[Header illustration: Shutterstock]