Go-Jek introduces PayLater, a new payment feature to facilitate customers with credit under a certain limit. PayLater is a Fintech Lending product from Findaya (PT Mapan Global Rekas), developed by Mapan. Mapan is one of the three fintech startup acquisitions by Go-Jek last year.

Findaya has acquired the license as a lending service provider from OJK. In its business, Findaya has worked for Go-Jek, Go-Food, Go-Clean, Go-Massage, and Mapan with various facilities, such as installment for laptop, smartphones and its accessories, and many more.

Catherine Hindra, Go-Jek’s Chief Commercial Expansion, said, PayLater for now is only available for select Go-Food customers. The select customers are sorted out by Go-Jek and Findaya without any further details.

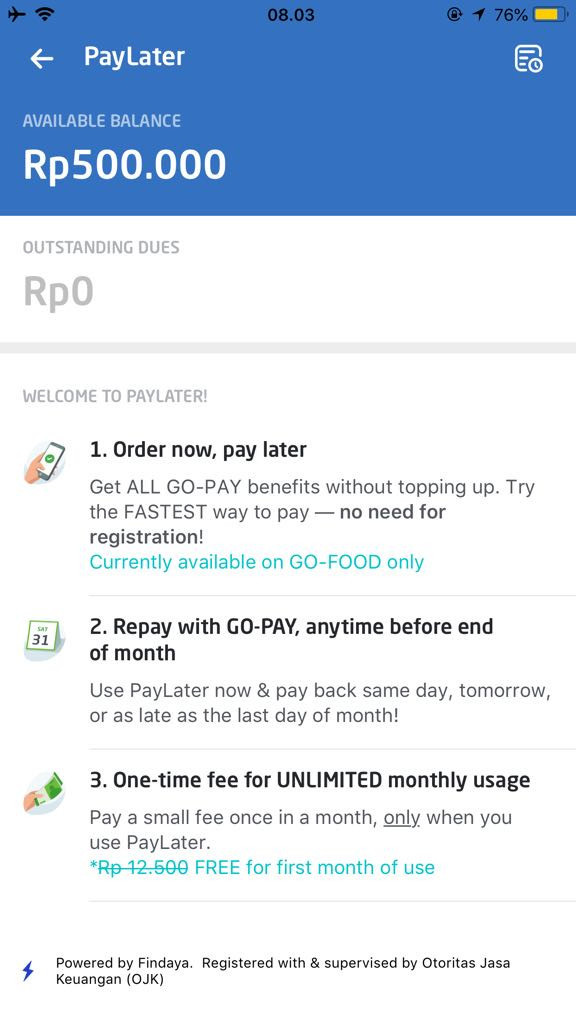

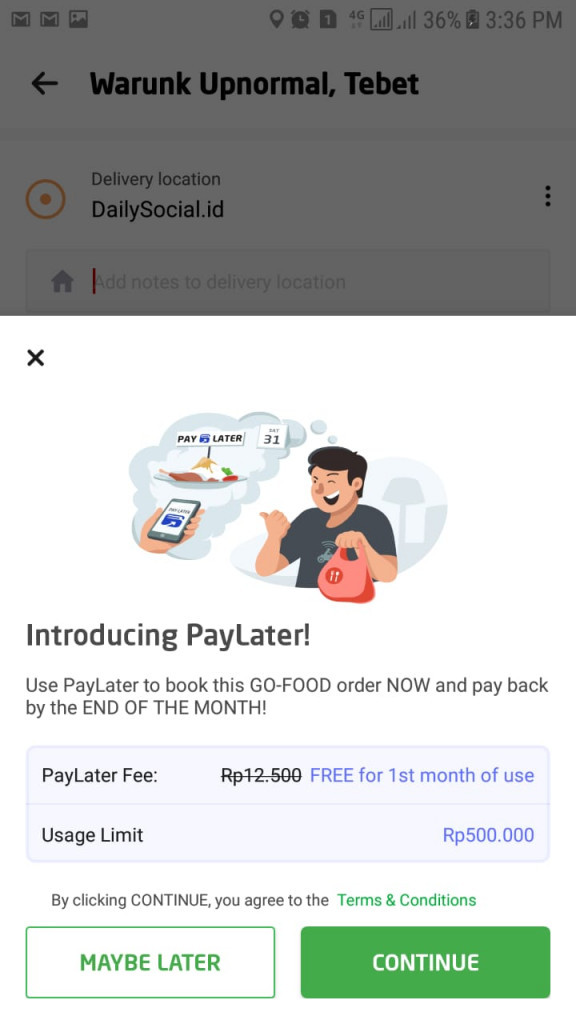

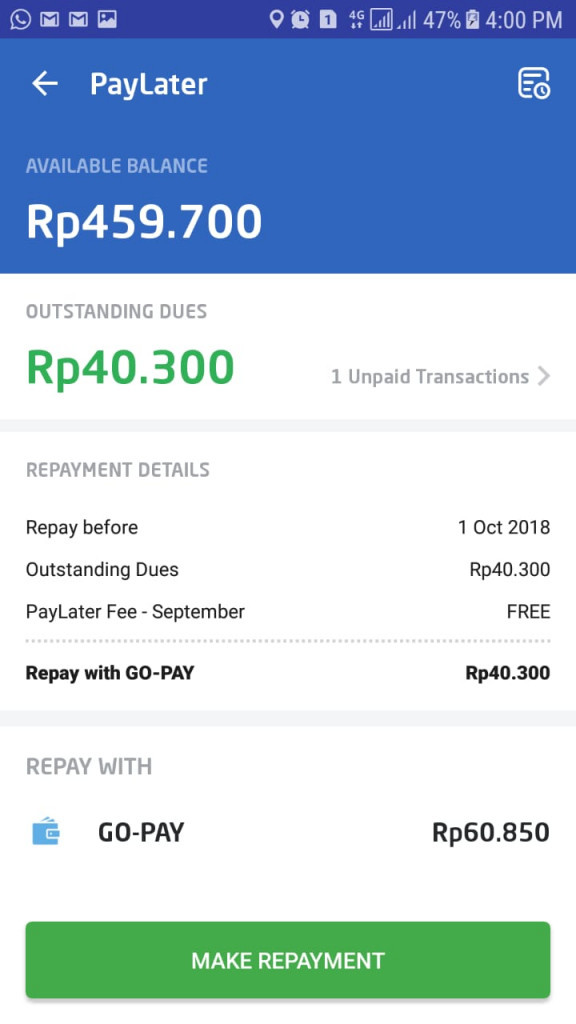

She illustrated PayLater mechanism similar to postpaid subscription. Customers have credit up to Rp500,000 and will be charged Rp12,500 monthly fee.

“Our focus with Findaya is to give the best experience for Go-Food’s select customers. We’ll learn from this to develop subscription feature in the future,” she said to DailySocial.

Regarding subscription, she said, it’s to be billed every month when using PayLater. If isn’t exercised, this feature will not take any administration fee. Free administration fee promo was given for the first month.

Hindra has no further explanation on when this feature will be available to all Go-Jek customers.

PayLater exploration

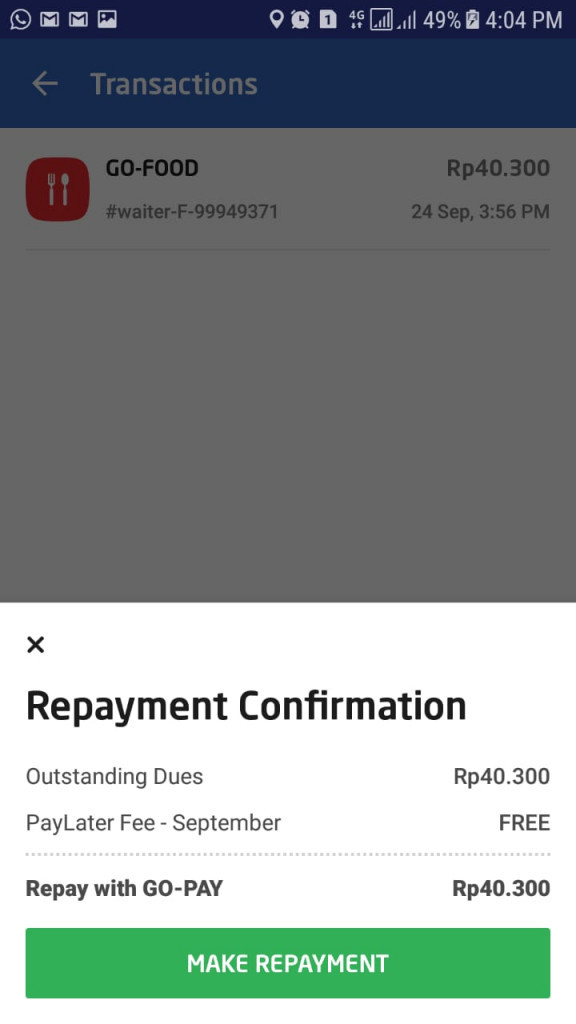

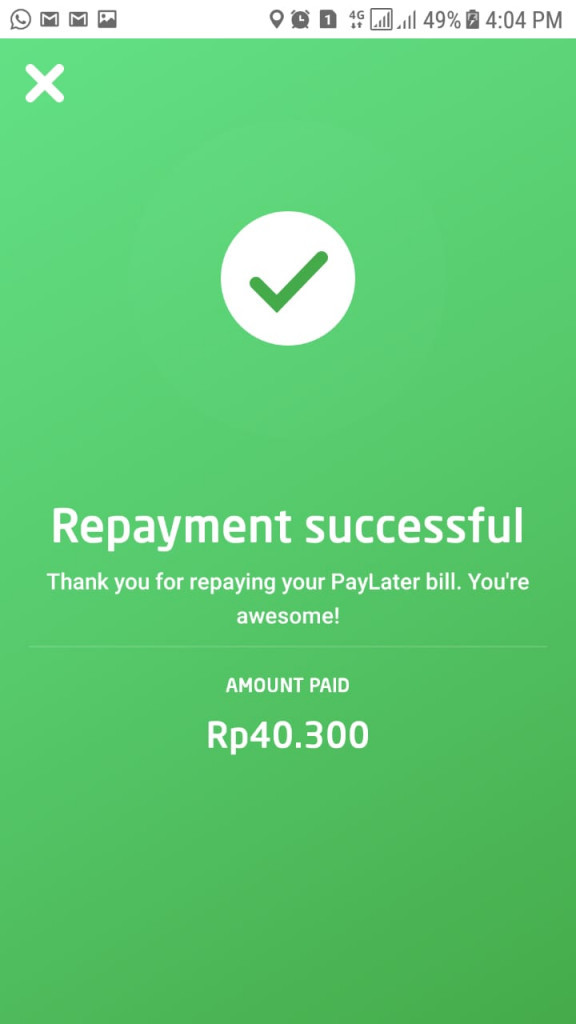

As we dig deeper, PayLater allows users to use credit up to Rp500,000. It should be paid before the last day of the month via Go-Pay.

There’s no further information regarding arrears and interest. Go-Jek will continue to provide notifications on the 25th of each month and every due date until payment’s finally made.

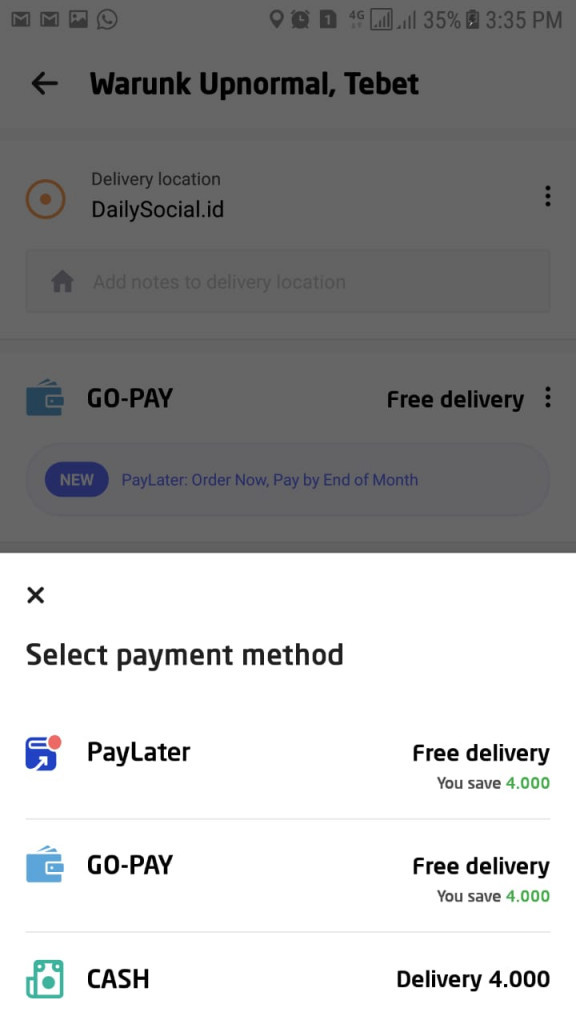

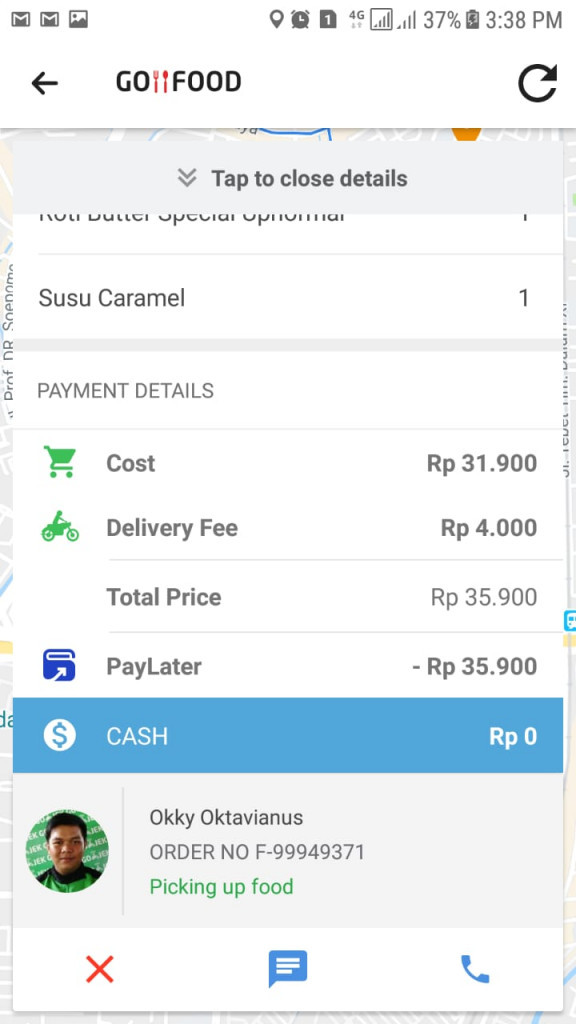

DailySocial has an opportunity to try this feature first. The flow is similar to Go-Food delivery, only on the check out page will appear PayLater as a payment option.

When choosing PayLater, the costs will automatically appear just as you’re paying with Go-Pay or cash. Once the order is received, the amount of PayLater credit will be reduced.

–

Original article is in Indonesian, translated by Kristin Siagian