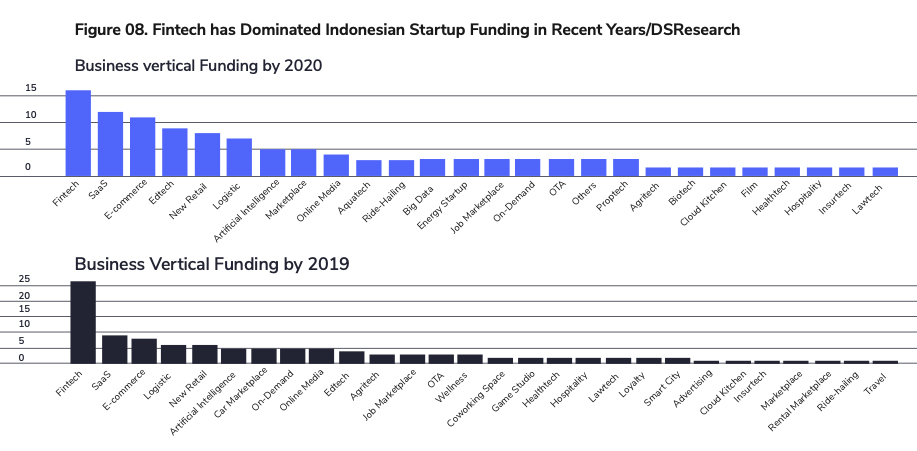

Talking of fintech (financial technology) industry in Indonesia, one thing that comes to mind will be its booming popularity. If you visit our website as of March 8th, 2021, the industry’s latest news is dominating the front page, including but not limited to (another) fresh funding, business update announcement from the government-owned e-money, the milestone of a P2P lending player, and editorial signature opinion on the fintech business for payment transactions.

The existence of the fintech industry in Indonesia is said to be crucial in supporting the digital startup ecosystem acceleration. The role is considered to support startup players, from facilitating payment services, converting cash to non-cash transactions, and unlocking financial access for unbanked societies in Indonesia. The significant role has created a chunk of potential for the fintech industry.

Behind every theory, there must be an anti-theory. It also applies in the fintech industry. Behind its notion of disruptive power and meteoric growth, there is an assumption that “fintech is boring”.

DailySocial.id, through DSResearch, released the annual report about the fintech industry in Indonesia at the end of last year. Stated in the report, facts of extraordinary positive achievements by fintech companies amid economic uncertainty during the pandemic. However, how come people still thought fintech is boring? What kind of factors are in play behind this assumption?

In a casual discussion at the currently-popular app, Clubhouse, we invited well-known startup founders and investors, including Ryu Suliawan (Gojek’s Head of Merchants & Midtrans’ Founder), Antonny Liem (GDP Venture‘s Investment Partner ), Alfatih Timur (Kitabisa’s Co-Founder & CEO), Pamitra Wineka (TaniHub’s Co-Founder & President), and Aria Rajasa Masna (KaryaKarsa’s CTO) to explain the answer to these questions.

“If we look at the system, regulations, and so on, it is only natural that fintech is considered boring because that is fintech. There are processes that tend to be tedious behind their roles which make it easier for startups and the market,” Liem said as he began the discussion.

From the fintech player’s perspective with experience in the payment gateways, instead of boring, Suiawan predicted that the current fintech industry will encounter a bubble moment as the finance industry is considered as a sexy business.

“In any era, when the finance industry is considered sexy, the bubble phenomenon [in the financial industry] will definitely occur and eventually explode. It has happened in the 80s, 90s, 2000s, and maybe it will also happen in this era, it [a bubble in the fintech industry] could happen soon,” he said.

The assumption does not necessarily mean that fintech is a fragile industry. The tedious process actually forms a reliable fintech industry to accelerate the digital startup ecosystem in Indonesia.

Aria said that the availability of fintech services is very much needed, even though the current business does not directly intersect with the fintech business.

“In my opinion, fintech is like infrastructure for an ecosystem. Its existence should first be built to move the industry. This is proven through KaryaKarsa. The fintech existence really helps us accelerate. For example, with the e-wallet service. Five years ago we still struggle with the manual transfer method,” Masna explained.

The above response is one of the reasons why fintech is flourishing in Indonesia. According to data compiled by the Fintech Report 2020, fintech services that serve the field of lending, both for productive and consumptive, currently have 152 players with a total loan distribution reaching 128.7 trillion Rupiah. No wonder the fintech industry is quite booming with the arrival of new players. However, what actually makes Indonesia an attractive market?

“We can start from the fact that Indonesia is one of the countries with the largest net interest margin (NIM) in the world. It is said that Indonesia’s NIM is phenomenal. I myself am not sure there isanother country with the same size that can achieve the very large NIM,” Suliawan said.

Agreed with Ryu, Pamitra Wineka, familiarly called Eka, has his own view on why fintech still holds enormous potential, even though its existence is getting saturated. As the founder of one of the leading agritech platforms, he thought the real potential area of the fintech market is far away from the downtown. As long as the infrastructure is well developed.

“We have large market potential for the fintech business, but infrastructure is the key. Currently, big players in e-wallets, such as GoPay, Ovo, LinkAja, seem to be busy competing in a small market, the big cities. Even though we know that the large market potential is in rural areas. We’ve found the fact that the area holds very large potential, but many transactions are still using cash. Therefore, it becomes potential if we can convert them to e-wallet services or similar,” he said.

Timur agreed. An important figure behind Kitabisa social platform, who is familiarly called Timmy revealed that the existence of fintech could provide a solution for the platform he founded.

“For me, fintech is important. Looking at the habit of donating which is quite driven by emotional factors than a necessity, we see that the payment issue is quite crucial. If the process is inefficient, untrusted, it can hold the benefactors. Initially, we only had a bank transfer facility with a unique code which was quite a hassle. As we implemented the e-money service, it was very helpful and the benefactors like it,” Timmy said.

Indonesia is one of the country with the largest net interest margin (NIM) in the world. It is considered phenomenal. i myself am not sure there is other country with the same size can achieve the very large nim.

Ryu Suliawan

Gojek’s Head of Merchants & Midtrans’ Founder

By implementing fintech services, he admitted to found two interesting things. First, fintech opens up the possibility for micro-donations that drives transactions number to increase significantly. The second interesting thing, he said, is that the implementation of fintech is able to deliver a new segment of the Kitabisa platform. Electronic money services are able to invite young people to become philanthropic as the more efficient donation process.

Observing the development of fintech innovation in such a way, is it still relevant if we think fintech is boring?

“I think fintech will become boring if we only focus on building infrastructure in big cities, without focusing on developing services in villages, rural areas, and so on,” Eka explained.

Eka’s opinion serves as a warning to the fintech industry about a potential market that should be a new innovation focus.

Moreover, how should the fintech industry move forward? Both Ryu, Antonny, Aria, Timmy, and Eka agree that the future of the fintech industry depends on the support of various parties.

“In my opinion, in order to not be boring, fintech also needs support. For instance, the e-commerce industry also needed prior support from fintech, therefore, the ecosystem is getting mature. Meanwhile, in fintech, the necessary support comes from infrastructure, government regulations, and so on,” Eka concluded.

After a long discussion, I came to the conclusion that maybe fintech should be stable and be mistaken for “boring”. Fintech is infrastructure, the foundation on which many creative services of various types can focus on delivering value to their users, without busy taking care of things such as payments, consolidation, provision of capital. Also, as an infrastructure, fintech must be stable. It may seem boring at first, but to me, fintech future potential is actually wide open, very broad, and very inspiring.

–

Original article is in Indonesian, translated by Kristin Siagian