Cashcash, a financial technology service running a business in Indonesia, has just received Series A funding. However, the business license of service as a P2P lending aggregator is yet to be issued. The website (cashcash.id) is blocked by Telkom and Telkomsel, the app is not available in Indonesia. CashCash is not a P2P lending but an aggregator collecting online loan products and providing discussion feature for its users.

According on the Kr-Asia report, CashCash managed to secure Series A funding worth millions of dollars from Zhen Fund, Zero2IPO, and Rong360. Lin Yi, CashCash’ CEO, said in the report that CashCash was well received in Indonesia, in a position as an aggregator or user liaison to other online loan services. CashCash also said to provide the best loan service with a feature for the user community to rate, comment, and compare the current fintech products.

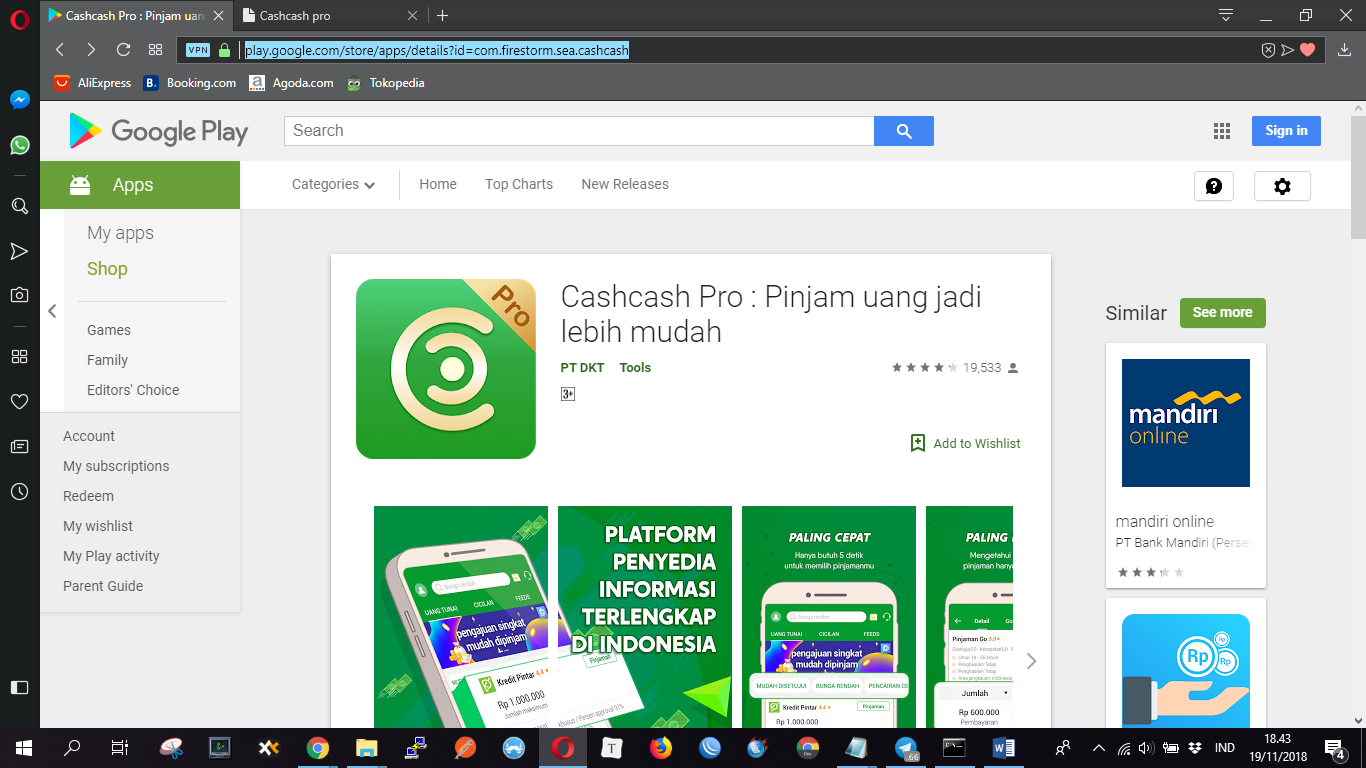

In Indonesia, CashCash, developed by Firestorm-sea included in the list of the unregistered or unauthorized services in OJK, Indonesia’s FSA. DailySocial acknowledges there are two sites related to CashCash. First is CashCash.id which already blocked by Telkom and Telkomsel.

Then, there’s also a mobile app which hasn’t available in Indonesia. It refers to the CashCashpro.id managed by PT Digital Kuantum Teknologi (DKT).

Lin Yi on the report said CashCash involved in the list of unauthorized financial technology services because they’re in the process of submitting business license in Indonesia.

He emphasized on CashCash position, not as a P2P service. It only provides a list of loan products collected from more than 60 third party online loan providers with the feature for community comments for users can discuss in advance.

P2P lending is getting more attractive

It was getting crowded with many of China’s P2P lending services entering Indonesia. The government had issued the list of unregistered services to prevent the public from unreasonable interest.

The online loan industry becomes the most popular financial technology sector in Indonesia. Bank Rakyat Indonesia, as one of the largest in this country, will issue an online loan service adopting the P2P lending system. It’s called Pinang and managed by BRI Agro.

–

Original article is in Indonesian, translated by Kristin Siagian