A startup developing a financial record keeping app for SMEs, BukuKas, today (12/1) announced Series A funding of $10 million or the equivalent of 142 billion Rupiah. This round was led by Sequoia Capital India with the participation of previous investors, including Saison Capital, January Capital, Founderbank Capital, Cambium Grove, Endeavor Catalyst, and Amrish Rau.

Founded in 2019, BukuKas has successfully raised $22 million or the equivalent of 313 billion Rupiah from investors – including through seed and pre-series A rounds. The additional capital will be focused on accelerating merchant acquisitions and building up the technical/product team at the Jakarta office. and Bangalore.

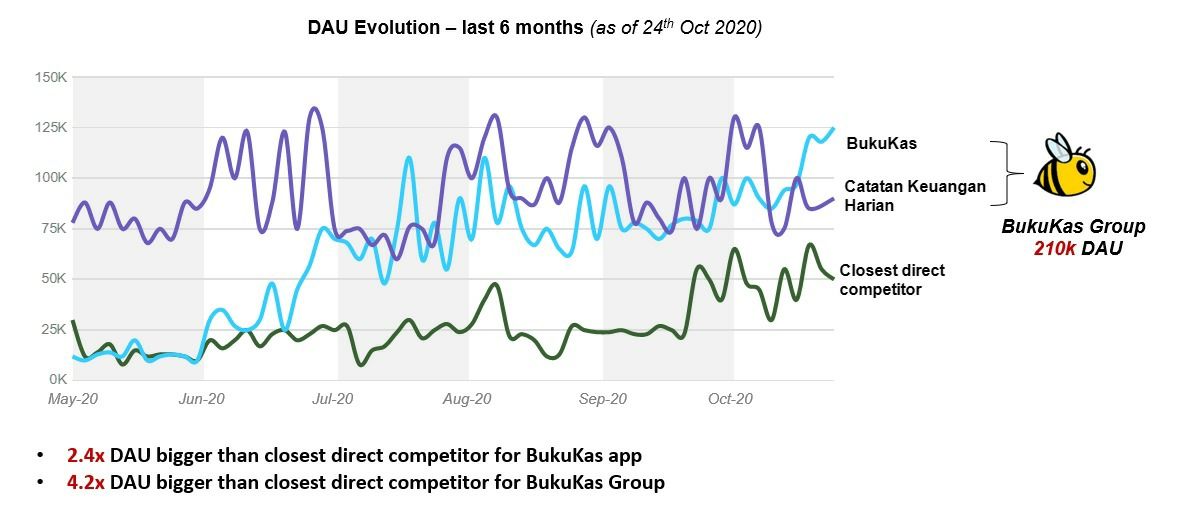

As of November 2020, BukuKas users has reached 3.5 million with 1.8 million active monthly users. However, BukuKas has quite some competitors in market share. The closest one is BukuWarung, with a business model similar to that of millions of users. In addition, there are several local startups that have also launched SME financial records applications, including Credibook, Moodah, Teman Bisnis, Akuntansiku, etc.

“To date, we see this funding round as a strong belief in a huge market opportunity, as well as team and execution capabilities. Even though we have grown rapidly this year, we are just getting started. This round is an important step for us to continue working towards our mission to empowering 60 million small traders and retailers in Indonesia so that they go digital,” BukuKas’ Co-Founder & CEO Krishnan Menon said.

In a previous interview with DailySocial, he said that his business is positioned as an SME digitization software company that will develop into a fintech player. “Sellers have realized that go-digital is very important to their business. Sellers save 2-4 hours a day, 20% in costs, and minimize manual calculation errors. We also allow merchants to recover debts 3x faster because the process is automated.”

Regarding its business model, he also explained, “We currently have an interesting initial experiment on monetization, but it’s still too early. It can be done in many ways, some of which are obvious like SaaS, financial solutions, and there are some interesting thoughts but we are yet to share.”

In its release, BukuKas also announced the acquisition of the Catatan Keuangan Harian app. This company act has actually been going on since last September 2020; expected of strengthening their leadership in related segments.

“Although the application features can be replicated as they develop, maintaining extreme levels of simplicity in products while adding substantial value will be a challenge. Eventually, companies that are able to make this happen on a large scale will take the lead,” said Krishnan.

With its unique characteristics, the Indonesian market does need a special touch. BukuKas team believes in this, which is represented in feature adjustments. For example, to be able to reach users in small cities, they present an offline mode with automatic synchronization when the user is successfully connected to the internet network.

Furthermore, BukuKas’ Co-Founder & COO Lorenzo Peracchione said, in the near future there will be several new features including digital payment integration. “Merchants will be able to collect money from their customers using various payment options in an easy way. Payments will be automatically added to the BukuKas application, which further automates the bookkeeping process and reduces the inconvenient process for our users.”

BukuKas also recently released an innovative inventory management module in its application. This feature allows small sellers to track the movement of their stock without creating complex frameworks that characterize today’s inventory management solutions.

–

Original article is in Indonesian, translated by Kristin Siagian