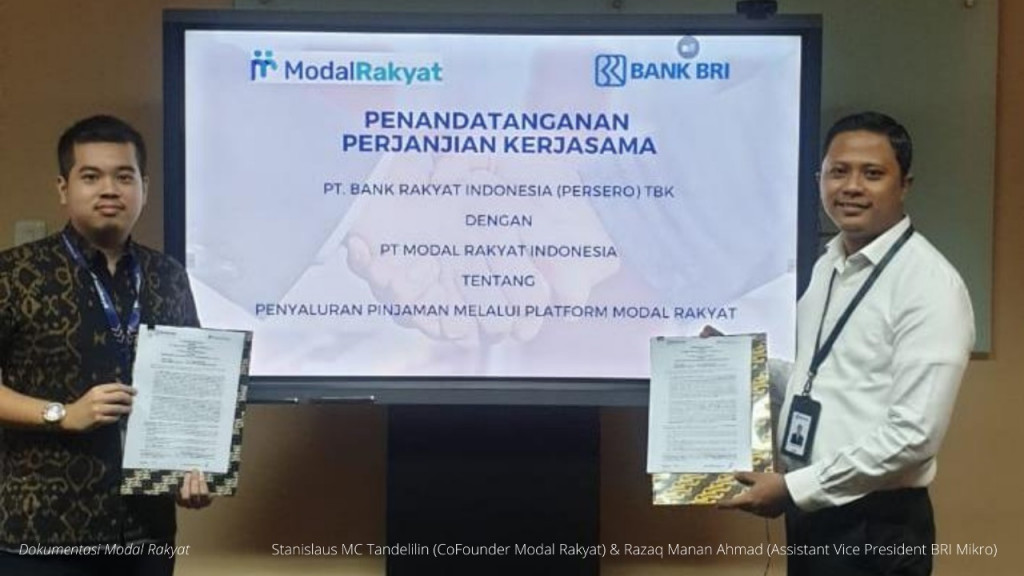

Modal Rakyat added BRI to the list of institutional lenders. BRI’s initial commitment was to channel funds of IDR 30 billion for micro-businesses through Modal Rakyat.

Modal Rakyat’s Co-Founder, Stanislaus MC Tandelilin explained that this is a form of collaboration between banking and p2p lending. All financing from BRI will be focused on micro-businesses with an average distribution value of IDR 250 million.

“We are very fortunate to have BRI’s trust. We hope this collaboration can accelerate financial inclusion, especially MSME players in the midst of a pandemic situation,” he explained in an official statement, Tuesday (13/10).

On a separate occasion, Stanis said to DailySocial that this collaboration was not part of the synergy between BRI and Payfazz. “Not related. PT Modal Rakyat collaborates independently with BRI.”

BRI, through BRI Ventures, was involved in a Series B funding round at Payfazz worth $53 million in July 2020. Payfazz, led by Hendra Kwik, also serves as a commissioner at Modal Rakyat, a company led by his brother Hendoko Kwik.

Furthermore, Stanis admitted that he would continue to add other institutional lenders, the closest is to link up BPR. Currently, there are nine institutions that have channeled their funds through Modal Rakyat, they come from multi-finance, corporate, and fintech. Unfortunately, they can reveal these companies yet.

The focus shifting on seeking institutional lenders is reflected in the current condition, there has been a downward trend in individual lenders. However, Stanis did not elaborate on the cause. “However, institutional lenders are starting to rise and now the majority of Modal Rakyat funding is supported by institutions. We are also exploring collaboration with BPRs.”

The total lenders registered in Modal Rakyat has reached more than 45 thousand people. Since getting a license from OJK in June 2018, the company has channeled loans of more than IDR 550 billion to 4 thousand borrowers throughout Indonesia.

The company is engaged in a productive business with loan interest ranging from 12% – 30% per year and a nominal loan of between IDR 500 thousand to IDR 2 billion. Borrowers only need to include their personal identity (KTP and NPWP), company legality data (if not an individual business), and have a bank account.

The trend of making benefit from Institution fund

In fact, individual lenders have much heavier management efforts than institutions. The reason is, companies must carry out an educational process through customer service to help guide risks and consultations, especially if they are just starting out the investment industry in p2p lending.

Meanwhile, institutional lenders are more familiar with the risks in this sector. For fintech making benefit from this massive fund, they will have the flexibility for they can distribute loans faster according to the target customers by each lender.

With these various advantages and disadvantages, eventually encourage some p2p lending platforms to combine the two in order to realize the spirit of financial inclusion. In previous reports, UangTeman announced Bank Sampoerna as one of its lenders.

Also, there are several other companies, including KoinWorks, which collaborate with Bank BTN, Bank Sampoerna, and Bank CIMB Niaga. Investee in collaboration with BRI Agro, Bank Mandiri, Bank BRI, and seven other institutions from financial services and investors from abroad.

Next, Modalku in collaboration with Bank Varia, Bank Sinarmas, BPR Bekasi Binatanjung, and BPR Sukawati Pancakanti. Finally, Akseleran, which collaborated with Mandiri Tunas Finance, Bank Mandiri, and Bank J Trust.

–

Original article is in Indonesian, translated by Kristin Siagian