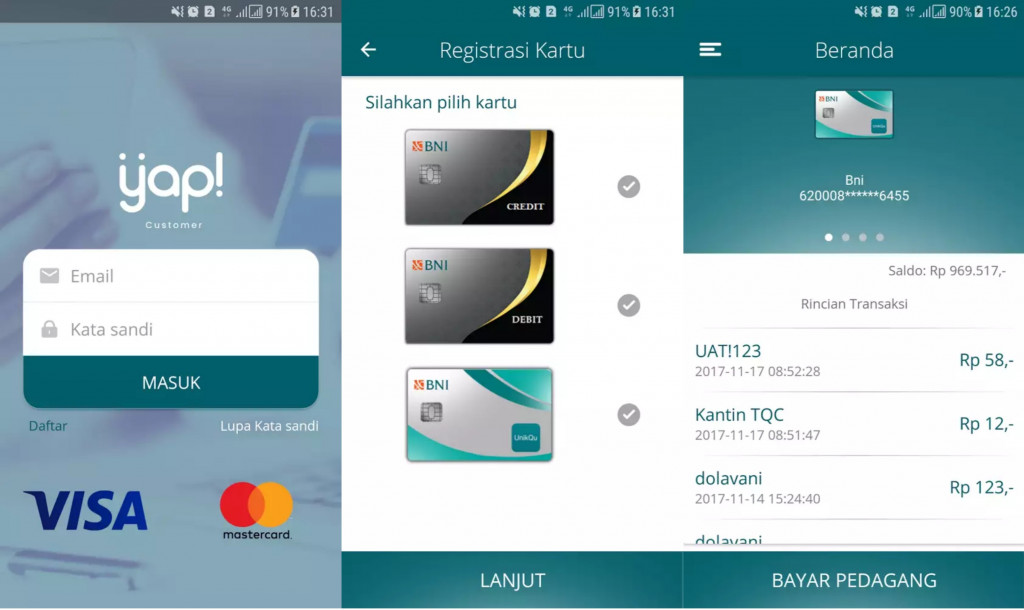

Bank Negara Indonesia (BNI) launches an app-based digital payment innovation called Yap that especially made for BNI customer. This app is designed to address

challenges, while meeting society’s need by providing mobile and simple payment mechanism.

Bob Tyastika Ananta, BNI’s Director of Planning and Operations explained that this application developed in collaboration between BNI in-house with some fintech startups. However, He wouldn’t mention any further details.

“BNI’s investment to build Yap ecosystem is not large. Yet, the app will be

internally managed by BNI,” Ananta said to DailySocial (1/25).

For him, Yap’s market segment is very wide starts from micro/SMEs, retail, chain

store, to premium brand segment. The presence of Yap is expected to be a solution for both bank customers and the corporate customers.

Ananta explained, in its business model, Yap provides three kinds of funding source to be used by customers, starts from credit or debit cards, and electronic money UnikQu. For the payment, Yap is using scan QR code through customer’s smartphone screen.

He ensures customers who has already using UniQu, this app is still available.

Whether the customer download Yap and use UnikQu with the same phone number, the balance will appear the same with the one in UnikQu app.

Some merchants already joined with Yap, including Cold Stone, Coffee Philosophy, Family Mart, Dinomarket, Super Indo, Blibli, Yellow Truck and 100 thousand other merchants scattered around Indonesia.

For the desktop version, Yap provides online new account services for both credit

and debit cards.

Previously, BNI partnered up with Dimo in delivering UnikQu. This app is using Pay by QR technology of Dimo to process payment transactions online and offline with various Dimo partners.

–

Original article is in Indonesian, translated by Kristin Siagian