The continuing crypto market downturn has certainly caused anxiety among the majority of investors. But some believe that this is actually a great time to go big on crypto and the broader web3 spectrum. Take Andreessen Horowitz (a16z), for example. The big-time VC firm recently announced a massive $4.5 billion fund for backing web3 startups.

This marks the fourth, and certainly the biggest crypto fund that a16z has launched. The firm has been investing in crypto since 2013, and with this latest fund, it has so far raised over $7.6 billion in total for blockchain-related investments.

In announcing the news, a16z said that it will use these funds to invest in promising web3 startups at every stage, with approximately $1.5 billion dedicated to seed investments, and $3 billion to venture investments. Some development areas that the firm is interested in include DeFi, decentralized social media, self-sovereign identity, Layer 1 and Layer 2 infrastructures, bridges, DAOs & governance, NFT communities, privacy, creator monetization, regenerative finance, new applications of ZK proofs, decentralized content & story creation, and of course, web3 games.

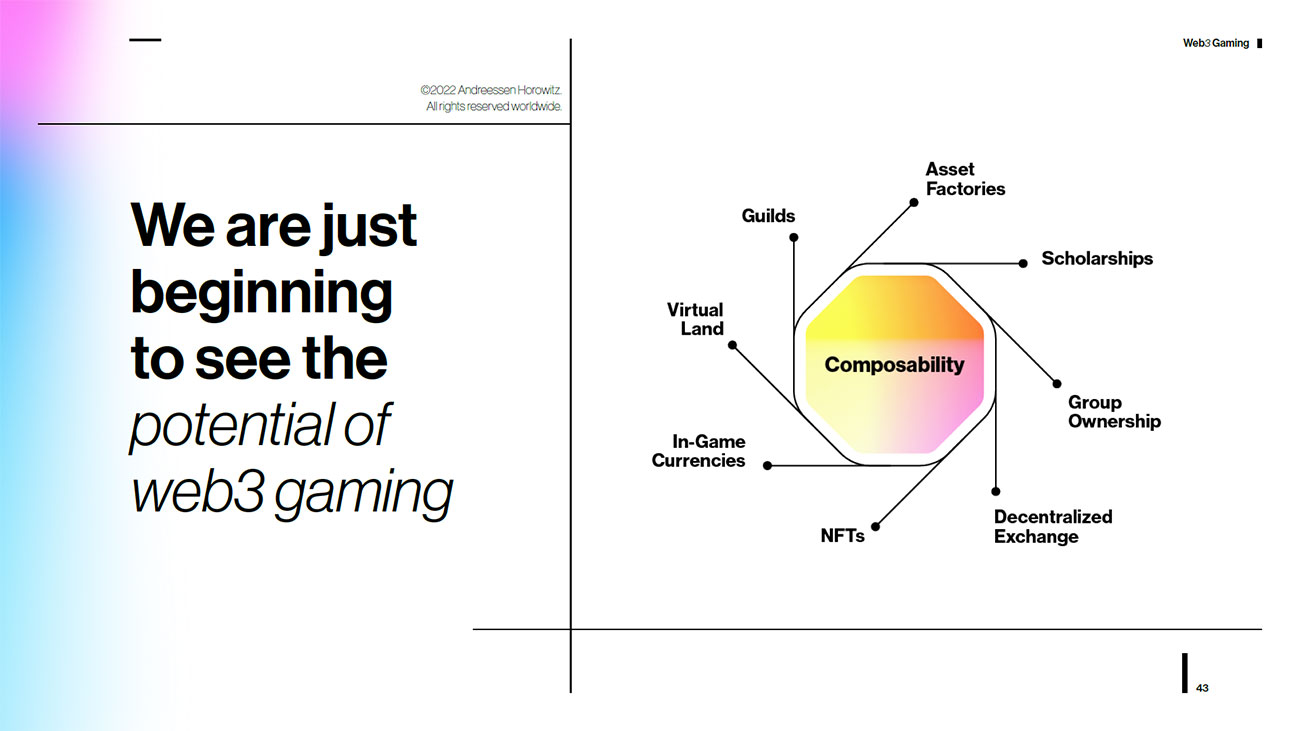

Speaking of games, a16z recently also launched a dedicated $600 million fund for the games industry. The firm is certainly betting big on gaming and the metaverse, saying that we are just beginning to see the true potential of web3 gaming in its recent State of Crypto report.

This isn’t the first time a16z is being bullish on crypto at a time when the market is losing its footing. The firm launched its first crypto fund four years ago, during a downturn now known as the “crypto winter”, and it is now essentially repeating itself with the launch of its fourth crypto fund.

Regarding this somewhat counter-intuitive move, Arianna Simpson, a general partner at a16z, commented in an interview with CNBC, “Bear markets are often when the best opportunities come about, when people are actually able to focus on building technology rather than getting distracted by short-term price activity.”

a16z believes that the world is now entering the golden era of web3, with programmable blockchains being sufficiently advanced and web3 apps having reached tens of millions of users. It likens the long-term opportunity in web3 to major computing cycles over the years, including PCs in the 1980s, the internet in the 1990s, and mobile computing in the 2000s.

Header image: André François McKenzie via Unsplash.