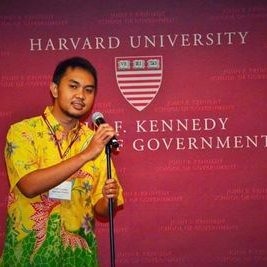

This article is a part of DailySocial’s Mastermind Series, featuring innovators and leaders in Indonesia’s tech industry sharing their stories and point of view.

As the sole founder of Amartha, Andi Taufan Garuda Putra has poured blood, sweat, and tears in building the company. With the story of being left by co-founders, the dilemma of choosing study over its own company. It’s all lead to the current situation where the peer-to-peer lending platform has delivered Rp1.25 trillion successful loans to over 200 thousand micro-entrepreneurs in the rural area.

He began the journey with a dream to enable financial inclusion throughout Indonesia. It’s a challenging one, considering the loan business is full of loophole and fraud potential. However, with perseverance as the foundation, he works his way up to the point where micro-businesses can contribute more to Indonesia’s economy.

In fact, he was recently appointed as one of the presidential expert staff by Jokowi. It’s definitely creating more pile of work on his desk. However, he’s eager to accept the challenge, it’s because he believes this country is moving towards a better economy and it’ll be incredibly great to be part of the change.

Let’s hear more of Andi Taufan Garuda Putra’s story through the excerpt from his interview with DailySocial’s team.

To begin with, you are one with an academic background in business. What’s your first thought on starting Amartha? What encouraged you to create such a thing with social impact?

I was getting my business degree without any aspirations to become an entrepreneur. My parents are struggling with their professional career, so I was just planning to follow their path. I was also planning to get my master’s degree and build a professional career worth living. Once I become successful, I would spare some for those less fortunate people. I used to have a simple definition of success, it’s when I turn 50 and have nothing to worry about on my plate.

After graduating from college, I was working at IBM for two years as a business consultant. My job is basically involving palm oil companies to implement the IT system in rural areas. While circling around the less-urban spots, I found out a significant gap between the rural and urban areas, such as Jakarta. It encourages me to make a move, how to contribute more to this issue. In my exploration days, I decided to create something more targeted. Instead of helping conglomerates bulking up their organizations, I need to make something more impactful for small businesses to grow.

It was in the early ’00s, nobody thought of fintech or application platform. After digging into some ideas, I finally settled with microfinance. It has a clear view, once you inject the first capital, cashflow will work out, it also comes with a significant increase in income. It also creates a multiplayer effect in the family, aside from growing business, their children can grow along and have a proper education.

You started Amartha in a cooperative form. Can you spare me the detail on your journey in building the leading peer-to-peer lending platform?

One afternoon, I was visiting a rural area in Bogor named Ciseeng. While exploring the village, I met some people and talked about the issues that often come up in the area. Most of them who stayed at home are women, their husbands were at someplace working informal jobs. As the head of the household didn’t earn much, the wives have to work part-time to improve the family’s welfare.

Based on this phenomenon, I thought they need some additional support. I started to provide small loans, starts from 500 thousand for 100 people in the first year. Talking about productivity, they take the loan seriously and use it for something useful, such as sewing machines and many more. Most of them are responsible enough to return the money on time. We grew by providing a thousand people the next year.

After five years serving over 7000 people in the rural, we’ve found the business quite challenging. At the end of the day, micro-loan has become more than just money, it is a hope for them. They started to make plans for the business and the family, and expect for more loans. With some bad credits and stuff, we were so close to run out of money and the “Amartha went bankrupt?” question has been thrown almost at every corner. It’s just hard, even for me too.

I then discovered that in this internet era, microfinance alone was not enough. We then come up with an idea to gain money from the public, such thing called marketplace peer-to-peer lending. With high-quality partners and the impactful loans, I had my pitch to the seed investors [BEENEXT and MidPlaza]. They turned out to love the idea and through ups and downs, Amartha finally launched its online platform in 2016.

The momentum is there, and more peer-to-peer lending platforms are to launch. Fintech industry is getting alive than ever. We also advised OJK to issue the regulations for the newborn p2p lending industry. Amartha then becomes one of the first batch p2p lending platforms to acquire the license from OJK in early 2019.

Talking about the crucial season, how did you cope with the situation and rise up?

It was around the year 2014-2015. People have turned their backs on Amartha, I, too, have doubt in surviving this company. I’ve thought about something new, and the good news from Harvard arrived. In the same year, investors are coming to the Amartha-near-falling-town.

It’s a dilemma, whether to take the school or take care of the company. I finally talked to the investors and they decided to let me continue with my study, under one condition, the platform must be launched as soon. It did happen in 2016. I was working remotely in the US with lots of help from Aria and the developer team. It’s a blessing to have a supportive team and a positive environment around you.

Being a sole founder is a different challenge for me. In 2009, I used to have partners, until one by one left because of the current situation back then. I tried again in 2014 with some partners before eventually two were left and the last one departed with another priority. I then realized that we have co-founders for every stage of Amartha, it is indeed important. In fact, today’s C-levels are very critical to help us moving to the next stage.

What is the next stage for Amartha?

It is when we go beyond peer-to-peer lending. We’ve been very good at providing micro-loan for women in rural areas. Stay true to our mission to deliver equal welfare for people in the last pyramid. If we’re to define the welfare it would be to reduce their cost of living, provide them with affordable products, therefore, they can spare money for savings, and start investing. How Amartha can evolve beyond p2p lending? It’s not only about supporting the initial capital but also to provide other products that can improve the quality of their lives.

How can you make sure the company stays true to the commitment?

The key is to embrace the problem. As the loan business, there are always people with payment past the due date, a loophole in regulations, potential for fraud. If we’re not to embrace, we’ll never improve. What I learned until now the employee has reached 2500, is how to build team with a mission. Their spirit should be aligned with the company’s overall mission. It’s to plant a sense of belonging in each employee. Once done, they can start to explore and move towards the goal. It’s quite challenging but worth fighting for.

As one of the first-batch peer-to-peer lending platforms in Indonesia, who/what is your role model for Amartha?

I was looking up to the US and Europe markets. They already have unicorn LendingClub in the US, and Europe market with its Funding Circle and Prosper. I’ve never seen one in Asia. Therefore, with a different customer base, I worked with what we have. As most of the Indonesian population is in the low-end pyramid, Amartha created a business model targeting mass-market and high-quality borrowers.

In the p2p lending landscape, do you have any issue with banking or any other departments towards financial inclusion?

Since the beginning, we have a clear division of roles. Everything we’ve done will not happen without banking infrastructure. On the other hand, banking is not likely to serve this segment, it’ll cost them a grand. Amartha knows the way to serve them and vice versa. This is all about trust issues and we’re fancy collaboration over competition.

Since the trend emerged in 2016 and more players arise in 2017. In 2018, the illegal issue comes up, and even though it’s not us, we’re still affected. OJK is said to take care of the issues this year and association is doing its homework. I see the future will be filled with collaboration, not only funding with banking but something more solid and intense. Also, there will be new ones offering more sophisticated products to run financial inclusion. And I’m always positive with the new founders, because that is what we need, more aggressive and positive people.

In over 10 years, you have poured blood, sweat, and tears into this company. Have you ever thought of creating something new?

It’s still a long way to go for me to get there. Amartha is still in the growth stage, it’s also a different business scale with Google or others. Especially with my recent appointment as the presidential expert staff. I currently have a lot on my plate these days.

Startup players might have known to have “innocent” political views, but you’ve changed it. What makes you so eager to achieve the challenge?

We have a president who is sincere and I’m more than happy to support him. We had a discussion on Indonesia’s small businesses. He wants to make a change, for bureaucracy’s engine can move faster towards future trends. A mandate for Indonesia to be the world’s top 4 of the country with economic power. This is to be built with positive energy and optimistic people. I, along with the other staff, believe that this is a small step to create the confidence to bring Indonesia to the next level.

With the current framework thinking in startup companies, which is fast. Do you happen to experience a clash of culture with the bureaucracy?

It is our duty as the presidential expert staff to provide innovative thoughts and breakthroughs as the president move bureaucracy’s trains with technology and digital approach. First look at the goal, I have yet to face the clash of anything. It’s a good thing that I still get the chance to work in Amartha, therefore, I can balance the startup with bureaucracy stuff for now. Let’s see what’ll happen six months from now.

Looking back at where you start and how it turns out today, what can you say to the early entrepreneurs facing near-failure situations like yourself back then?

If I were to say something, it would be to stay true to your long term goal, because perseverance will eventually pay off. For those who just started, it’s not about the people, or the money, or the technology. It’s when you find the one thing to focus on and let no distractions come in the middle. Failure is part of the journey. We fail when we stop.