Amar Bank launches a personal financial management app, Senyumku. This app uses Google’s recent cloud solution launched last week.

Senyumku is designed to provide an easy and secure saving experience, by providing personalized information, therefore, it acts as a reminder or personal financial advisor for each customer.

“[…] What distinguishes Senyumku from other digital banks is the intelligence-based AI in managing information in order to encourage customers to increase their savings,” Amar Bank’s President Director, Vishal Tulsian said in an official statement on Wednesday (1/7).

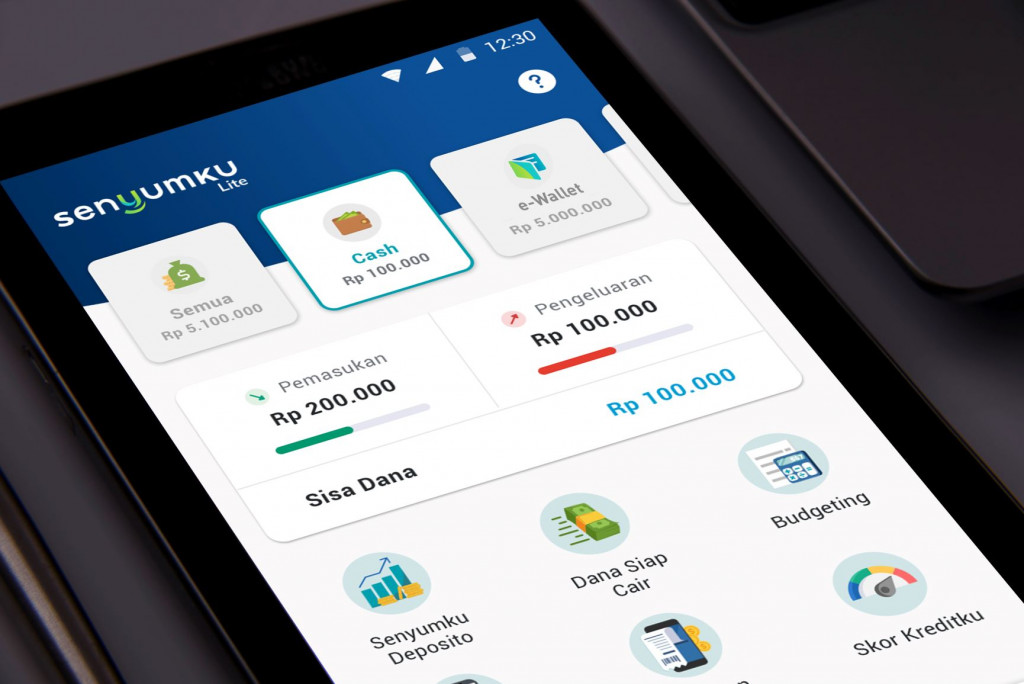

As a financial management application, this app has features include recording and managing customer financial information, in the form of cash, electronic money, and balances in bank accounts. Customers can input income and expenditure information manually with complete information on category and transaction.

Other supporting features include budgeting, fast loans, online accounts, automatic bills, and credit scores to get loans.

“Senyumku will come in a full version with sophisticated AI technology to enhance the features of financial advisors, and to enable customers to be able to access all banking transaction activities.”

Currently, Senyumku is available in the Lite version on Google Play. In order to become a customer, simply register by entering your name, email address, and mobile number.

To date, Senyumku only accessible for personal financial management to record income and expenditure from various sources of funds and investment deposits. In order to add another bank account and e-wallet, it acts as information in personal financial management. It’s unlike integrating directly with the institution.

Another bank-based financial management application that is quite successful in Indonesia is Jenius. Currently, Jenius has developed many features since it was first launched in 2016. The latest feature is Moneytory to assists customers manage cash flow and is recorded automatically from the main debit card.

Google Cloud Assistance

Regarding cloud service, Tulsian explained that Google Cloud offers solutions that support the company’s IT infrastructure as a digital bank. Since Google Cloud’s regional launch in Jakarta, the company has used its technology for various business cases, such as product and feature launches, Big Data architecture, AI and Analytics, and others.

The company’s collaboration with Google Cloud is supported by FIS Cloud and Infofabrica which enables the company to utilize data analytics and machine learning to deliver personalized customer experiences faster.

The company utilizes Google Cloud solutions, starting from the Kubernetes cluster solution with the Google Kubernetes Engine (GKE) which allows the company to manage and scale up services more easily and cost effectively. Next, Google Data Analytics and AI are the keys to providing a better customer experience.

–

Original article is in Indonesian, translated by Kristin Siagian