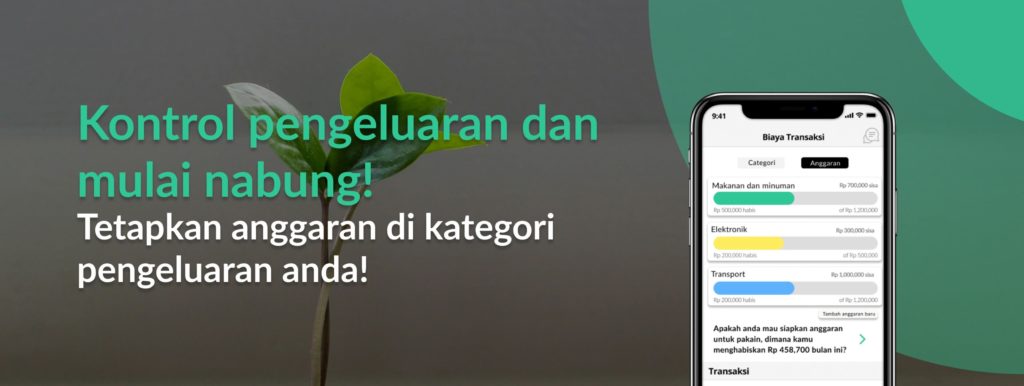

In recent years, more digital bookkeeping platforms have emerged in Indonesia. Aside from the integration with banking, digital wallets to other fintech platforms; it also leverages the latest data and technology to function as a personal finance application.

One of the platforms launched this year is Finku. This service was founded by three Co-Founders, Shyam Kalairajah, Reinaldo Tendean, and Shylla Estee Pramadhani. Both Shyam and Reinaldo had previously worked at the Boston Consulting Group (BCG), while Shylla had previously worked at Bukalapak.

According to his Linkedin page, Reinaldo mentions Finku’s vision to democratize finance for all Indonesians. He believes that Indonesian people regardless of their background have the same opportunity to make the best financial decisions.

“And we started this journey by providing infrastructure and tools to make simplify financial management, make it faster and more seamless. Indonesians no longer have to spend time manually tracking their expenses, through manual tracking apps, excel, or notes.”

Finku has partnered with KoinWorks and Flip. In addition to providing a reporting tool for various activities by manual input, Finku is also capable to manage user expenses using budget feature. Other favorite features include Timeline & Filter, Financial Target, Centralized Dashboard and Promos, discounts, and cashback. The Finku app is now available for download on Google Play and the App Store.

DailySocial tried to contact Finku’s founding team, but they were unwilling to comment.

In Indonesia, other platforms that provide similar services to Finku include Moni, Sribuu, and PINA.

Pre seed funding

Currently, Finku has been registered and supervised by Kominfo and the Indonesian FinTech Association. Around last August, Finku also received Pre-Seed funding from Global Founders Capital and 500 Startups.

DailySocial noted that there were 3 digital bookkeping services such as Finku that had received funding from investors during 2021. One of which is Sribuu that receives funding from BEENEXT and several angel investors, while Moni received seed funding from Bukalapak’s Co-Founder, Achmad Zaky. Before the application was launched, PINA had secured seed funding from 1982 Ventures, iSeed Asia, Prasetia Dwidharma, Oberyn Capital, and a series of angel investors.

The pandemic in particular has accelerated the growth of financial record-keeping platforms. The habit of online shopping among the public during the pandemic has encouraged the acceleration and adoption of non-cash transactions.

BI data also recorded an increase in digital transactions that reached 201 trillion Rupiah in 2020, rise 38.62% from 192 trillion Rupiah in 2019. It was also recorded that the use of electronic money reached 24 trillion Rupiah during June 2021, increased by 60% compared to the same period in 2020.

–

Original article is in Indonesian, translated by Kristin Siagian