Recently, Bank Indonesia (BI) announced the rapid increase of QRIS based payment transactions over the past year. The transaction value has reached Rp 9 trillion in the first semester of 2021 or increased by 214% compared to the same period last year. The increasing number also happened to merchants using QRIS at 8.2 million. At least, there will be an increase of around 3 million from 6 million merchants at the end of 2020.

In a Digi X webinar held by Infobank, Bank Indonesia’s Assistant Governor and Head of the Payment System Policy Department, Filianingsih Hendarta, said that the Covid-19 pandemic has had a significant booster effect on the acceleration of Indonesia’s digital finance. Aside from the shifting consumer behavior to digital, this acceleration is backed by the players’ collaboration in the digital ecosystem of the banking and non-bank sectors.

“In the near future, we are to launch the Customer Presented Mode feature as we currently have Merchant Presented Mode. We are also piloting QRIS transactions for cross borders, both inbound and outbound,” said the woman familiarly called Fili.

With the unexpected achievement, how is the manifestation of QRIS implementation in the future during this situation, and what kind of efforts are needed to encourage its adoption?

About QRIS

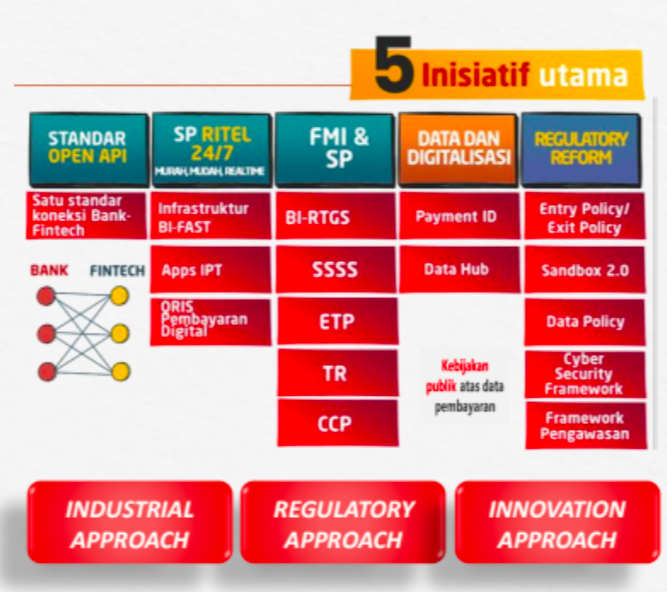

QRIS or Quick Response Code Indonesian Standard (QRIS) is part of Bank Indonesia’s five major initiatives towards the Indonesian Payment System (SPI) 2025.

QRIS was developed by Bank Indonesia and the Indonesian Payment System Association (ASPI) to combine various QR codes from various Payment System Service Providers (PJSP) into one QR Code. As a digital payment system, QRIS is designed as a QR Code Standard for server-based electronic money applications, digital wallets, and mobile banking.

Technically, QRIS is available in two types. First, in a static format (print media/stickers, one QR Code for every transaction, QR Code does not have a nominal value, only manual input). Second, dynamic (QR Code through receipts printed by the EDC machine/appears on the monitor, different QR Code for each transaction, QR Code has a nominal payment).

People can make payment at merchants with one QR Code for all platforms. The scenario is, if you can’t buy drinks because the relevant merchant doesn’t accept your payment option, QRIS will enable the merchant to accept every payment from each platform. It will no longer require one EDC machine for one platform. QRIS provides space for the public to make payments regardless of the platform with one QR Code.

Therefore, why do we need QRIS? This technology can expand national non-cash payments acceptance in a more efficient way. Through the use of one standard QR Code, goods and services providers no longer require different types of QR Codes from different publishers.

Long before QRIS was launched, the government had implemented QR Code as a payment option since the middle of 2015. However, PJSP was using QR exclusively at that time. With the growth of smartphone penetration and the opportunity to help the unbanked and underbanked segments, BI decided to create the QR Code standardization.

Another reason is that BI discovers a high success rate in QR as a payment option in several countries, China through Alipay and WeChatPay, and India through PayTm and BharatQR.

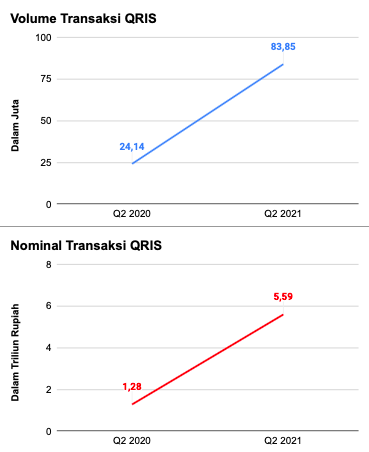

Two years after its official launch, QRIS reaped positive achievements–mostly helped by the pandemic. Based on BI’s data, QRIS transaction volume rose 247% in the second quarter of 2021 to 83.85 million transactions. Meanwhile, the transaction value skyrocketed 336% to Rp5.59 trillion compared to the same period last year.

Similar to QRIS, other players and industries in the digital financial ecosystem are also experiencing positive growth due to the pandemic. As Fili said at the webinar, the growth of the digital financial ecosystem (EKD) this year is projected to continue to increase.

Adoption and Challenges

Considering its premature stage, QRIS’s adoption progress has not been massive. Many consumers find it difficult to use it, especially with today’s society limitations. It is visible from a small survey, involving 65 respondents, conducted online by DailySocial in August 2021.

This survey may not be able to represent the major issues in the field, but respondents provide interesting perspectives as a room for improvement to the stakeholders involved.

First, the transaction challenges using QRIS. Based on respondents’ answers, as many as 65.6% admitted that many merchants are yet to provide QRIS option. Furthermore, around 55.7% said that internet connection may hamper the transactions, and 29.5% of respondents said that the QRIS has a relatively long scanning process.

An interesting fact is that several respondents highlighted how some merchants only used QRIS as a display. They said there are some merchants that provide QRIS, but the cashiers rarely offer it to consumers as they are not familiar with it.

Meanwhile, some respondents admitted that they are not interested in trying QRIS because of its limited availability (60.9%), consumers do not know how to use it (17.4%), the feature is yet to available on the device (13%), and cashiers rarely offer payments with QRIS (4.3%).

From business players perspective, BI has applied some relaxation to the policies to reduce burden on its implementation. Quoting Kontan, BI announced the transaction fee or merchant discount rate (MDR) borne by partners/merchants will be 0.7%. Using QR only costs IDR 35 thousand for one QR code at each merchant.

Merchant expansion

The Covid-19 pandemic has had a positive impact on Indonesia’s digital financial ecosystem. However, the government and stakeholders should ideally not make this a temporary golden moment. There should be bigger room for improvement, therefore, QRIS adoption can consistently increase until the post-Covid era. Moreover, some people are getting used to the digital payment transition,

The remaining information, many respondents expected the QRIS adoption could be expanded and not limited to food and beverage transactions. As many as 87.3% of respondents expect QRIS to be used on street stalls, 81% in markets, 76.2% for government services, and 68.3% for public transportation.

The government also needs to explore how to maximize the QRIS adoption and whether social restriction policy is to continue. With the social restriction in public places, such as shopping centers, how do people suppose to use QRIS while many merchants are not operating. Except for food delivery orders.

As reported by Bisnis, BCA experienced a decline in physical transactions, which affected services using the QRIS method. Meanwhile, based on our respondents’ answers, they began to use QRIS less frequently since the social restriction for the last few months. As many as 20% of respondents admitted that they only make transactions once in 3 months and 2-3 times per month. A total of 16.7% said that they use QRIS for transactions about 2-3 times per week.

DailySocial seeks for Bank Indonesia’s comment regarding the related issues, but no further statement has been made to this point. BI has actually updated the policy on using QRIS by increasing the transaction limit from Rp2 million to Rp5 million.

Soon, BI is to release a Customer Presented Mode feature where merchants perform scans. However, is this enough? The government should not waste the momentum with the current digital acceleration and changes in consumer behavior.

–

Original article is in Indonesian, translated by Kristin Siagian