In a general note, the Covid-19 pandemic has had a serious impact on the world’s economy, both on a micro and macro scale. Various business sectors have also been affected, including those involved in the digital startup ecosystem.

The current condition has formed a lot of hypothesis. Some observers said that this year it is projected to be quite difficult for startup founders, especially those who are currently fundraising. It turns out that the statistics are still in the favor of the founders, at least based on the data for the first and second quarters of this year.

During the first quarter of 2020 (Q1 2020) we noted, at least 20 startups were announced and/or confirmed to the public. We conclude this number as relatively normal compared to similar periods in 2019. Based on the 2019 Startup Report, there were 27 transactions announced to the public in Q1 2019. The sequence trend is still the same, dominated by the early stage and Series A.

The early hypothesis said that this agreement is a result that was developed from the previous year, therefore, it has yet become a benchmark for a complete picture of the investment climate in 2020.

Tight investment scene

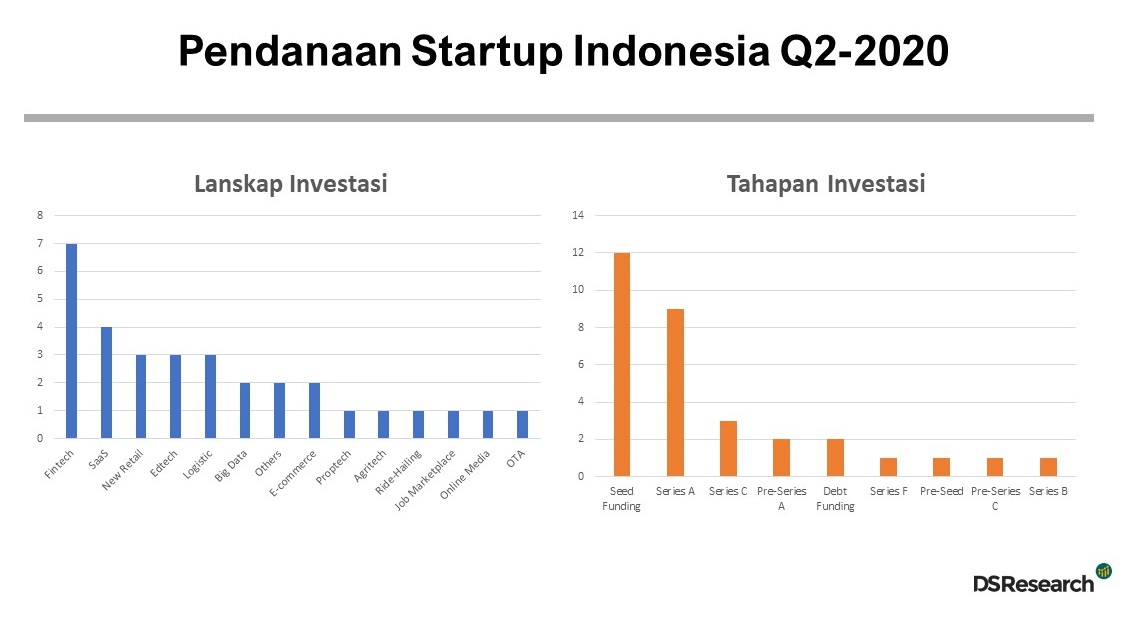

During the second quarter of 2020 (Q2 2020 in April-June) this year, we recorded that there were 32 startup funding transactions announced or confirmed to the public. This acquisition is higher than in the same period last year, which was 24 transactions.

Some funding is the follow-on/closing of a round that has started from a previous time period (marked *). There is also a new round with more involvement in the future (marked **).

The following is a complete list of funding, sorted by time of announcement:

| Startup | Landscape | Stage | Investors |

| InfraDigital | Edtech | Series A | AppWorks |

| Cinepoint | Others | Seed Funding | Ideosource Entertainment |

| Jendela360 | Proptech | Seed Funding | Beenext, Prasetia Dwidharma, Everhaus |

| Shipper | Logistic | Series A | Prosus Ventures, Lightspeed, Floodgate, Y Combinator, Insignia Ventures, AC Ventures |

| Fabelio** | E-commerce | Series C | AppWorks, Endeavor Catalyst, MDI Ventures, Aavishkaar Capital |

| Ula | New Retail | Seed Funding | Sequoia India, Lightspeed India, SMDV, Quona Capital, Saison Capital, Alter Global, angel investor |

| Wallex Technologies | Fintech | Series A | BAce Capital, SMDV, Skystar Capital |

| GoPlay | Online Media | Seed Funding | ZWC Partners, Golden Gate Ventures, Openspace Ventures, Ideosource Entertainment, Redbage Pacific |

| Gojek | Ride-Hailing | Series F | Facebook, PayPal |

| Job2GO | Job Marketplace | Seed Funding | BANSEA |

| Bonza | Big Data | Seed Funding | East Ventures |

| Delman | Big Data | Seed Funding | Intudo Ventures, Prasetia Dwidharma, Qlue |

| Bobobox | OTA | Series A | Horizons Ventures, Alpha JWC Ventures, Kakao Investments, Sequoia Surge, Mallorca Investment |

| KoinWorks | Fintech | Debt Funding | Lendable |

| Pintek* | Fintech | Pre-Series A | Accion Venture Lab, Global Founders Capital |

| Dekoruma | E-commerce | Pre-Series C | InterVest Star SEA Growth Fund 1, Foundamental, OCBC NISP Ventura, Skystar Ventures |

| Tokocrypto | Others | Seed Funding | Binance |

| Kopi Kenangan | New Retail | Series B | Sequoia India, B Capital, Horizons Ventures, Verlinvest, Kunlun, Sofina, Alpha JWC Ventures |

| KlikDaily | New Retail | Series A | Global Founders Capital |

| GudangAda | Logistic | Series A | Sequoia India, Alpha JWC Ventures, Wavemaker Partners |

| BukuKas | SaaS | Seed Funding | Sequoia Surge, 500 Startups, Credit Saison, angel investor |

| Bahasa.ai* | SaaS | Pre-Series A | East Ventures, DIVA, SMDV, Plug and Play Indonesia |

| Modalku | Fintech | Series C | BRI Ventures dan sejumlah undisclosed investors |

| Eduka | Edtech | Seed Funding | Init-6 |

| Qoala | Fintech | Series A | Centauri Fund, Sequoia India, Flourish Ventures, Kookmin Bank Investments, Mirae Asset Venture Investment, Mirae Asset Sekuritas |

| KoinWorks | Fintech | Debt Funding | Quona Capital, EV Growth, Saison Capital |

| Kargo Technologies | Logistic | Series A | Tenaya Capital, Sequoia India, Intudo Ventures, Amatil X, Agaeti Convergence Ventures, Alter Global, Mirae Asset Venture Investment |

| Investree** | Fintech | Series C | Mitsubishi UFJ Financial Group, BRI Ventures, SBI Holdings, 9F Fintech Holdings Group |

| Webtrace | SaaS | Seed Funding | Prasetia Dwidharma, Astra Ventures |

| BukuWarung | SaaS | Seed Funding | East Ventures |

| ProSpark | Edtech | Pre-Seed | Agaeti Ventures, Prasetia Dwidharma, angel investor |

| TaniHub* | Agritech | Series A | Openspace Ventures, Intudo Ventures, UOB Venture Management, Vertex Ventures, BRI Ventures, Tenaya Capital, Golden Gate Ventures |

Based on the table, in terms of the investment stage, most of the secured funds are in the early-stages (12) and the Series A stage (9). While in terms of the business landscape, the scope is quite diverse, mostly for fintech startups.

Startup ecosystem development

According to the Global Startup Ecosystem Report (GSER) published by Startup Genome, Jakarta ranks second out of 100 cities worldwide on the list of emerging startup ecosystems. The data used for the assessment is based on four main factors, such as performance, funding, market reach, and talents of each city.

Mumbai, which is ranked the first place, scored 10 in each of these factors. Jakarta scored almost the same number, only the talent metric got a score of 9.

Startup Genome also divides the ranking of each city based on the total value of the ecosystem and early-stage funding. Jakarta placed in the top position with an ecosystem value of $ 26.3 billion, followed by Guangzhou ($19.2 billion), and Kuala Lumpur ($15.3 billion).

Unfortunately, startup development is still centered in metropolitan cities like Jakarta. When the assessment is conducted nationally and averaging the performance of all cities, the ranking drops dramatically. For example, validated by StartupBlink in a report entitled The StartupBlink 2020 Global Ecosystem Report.

In 2020, Indonesia ranked 54th, down 13 levels compared to the previous year. In Southeast Asia, this position is only superior to Vietnam. Singapore is in the top position, which is ranked 16th.

This report highlights the contribution of several cities towards ecosystem development. In sequence, Jakarta, Bandung, Yogyakarta, Medan, and Semarang are cities wih the most significant growth in the startup ecosystem.

–

Original article is in Indonesian, translated by Kristin Siagian