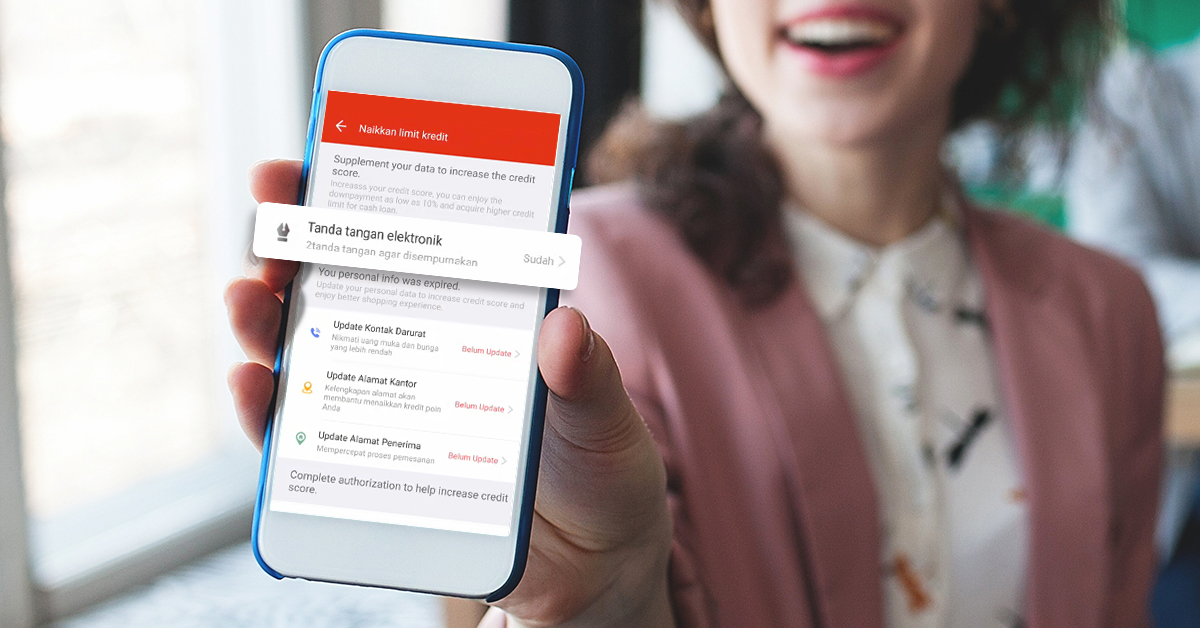

PrivyID, a digital signature startup, is actively collaborating to expand service network. The latest one is partnering with Akulaku, a fintech startup that offers online credit service.

“A digital signature startup PrivyID helps to facilitate user journey or customer travel in applying for loans. The complicated verification process has now become shorter and easier. It’s what consumers want nowadays, simple and effortless. The digital signature can be made easier without sacrificing security,” Marshall Pribadi, PrivyID’s CEO, said.

The partnership between PrivyID with Akulaku is officially established since August 2018. Previously, PrivyID has partnered up with finance companies, such as Bussan Auto Finance, Awan Tunai, KoinWorks, and KlikAcc. They also collaborate with an investment platform, Kerjasama.com, and mutual funds app, Kelola, to convert wet signature practice into a digital signature. Solution offered by PrivyID is claimed to be implemented in some top-tier corporates, such as Bank Mandiri, CIMB Niaga, Telkom, Adira Finance, and Indihome.

Until October 2018, PrivyID has 1.9 million users and soon to partner with BRI.

This year, PrivyID has a quite huge ambition. In an interview with DailySocial, the CEO mentioned their huge ambition to expand to four countries, targeting three million individuals and 200 corporate customers in 2018.

“We can at least expand into Southeast Asia, we intend to get there. Due to the ITE Law regulation, Indonesia is considered to have a tight competition compared to the British Commonwealth countries, such as India, Malaysia, and Singapore. Therefore, if the rules [Indonesian] comply, automatically it’ll comply in there,” he explained.

–

Original article is in Indonesian, translated by Kristin Siagian