Tribe Accelerator today (14/4) announced a new strategic investment from Mandiri Investment Management Singapore, a subsidiary of Bank Mandiri. Korea Investment Partners, Greg Kidd, and Stellar Partners are also involved in the first blockchain accelerator program supported by the Singapore government.

Apart from upgrading the accelerator program, funds will also be used for the development of the Tribe Academy; including to expand its business coverage to embrace more blockchain startups and talents.

In addition, Tribe also informed that the startups participated in its program have raised $70 million in funding, supported by global investors. Currently, it’s already 4 batches, some of the startups include DigiX, WhatsHalal, xfers, and others.

“We support cutting-edge blockchain startups from around the world, with a total valuation of over $1 billion, solving problems ranging from food safety to drug delivery […] We are delighted to welcome our new strategic investors from Indonesia, as well as the United States, South Korea, and Hong Kong to help expand into new markets,” Tribe’s CEO, Yi Ming Ng said.

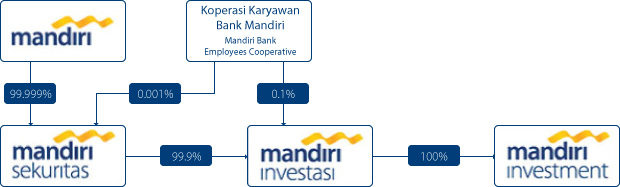

Meanwhile, Mandiri Investment’s CIO, Kevin Widjaja commented, “Mandiri Investment Management Singapore has a track record of supporting local startups, especially those at the forefront of deep technology. Over the years Tribe has supported several startups using blockchain for a variety of issues. Investing in Tribe enables us to help them expand their global footprint and network.”

Bank Mandiri’s digital transformation path

Even though with a broad use case, it is undeniable that in its initial phase, blockchain started to become famous as it is considered to be able to democratize financial services with a more efficient approach. In Indonesia, blockchain innovation is still very minimal – most used for matters relating to cryptocurrency assets.

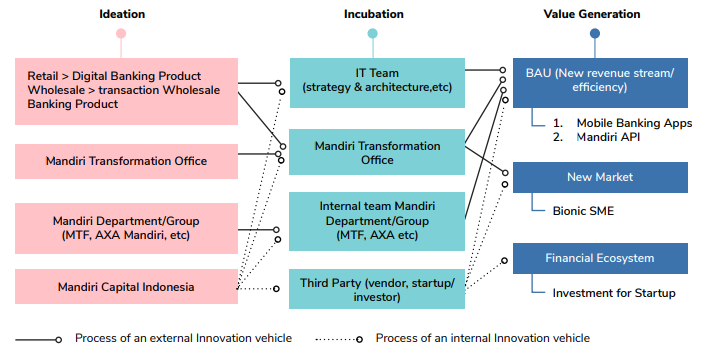

Bank Mandiri’s arrival into this landscape can also be interpreted as the company’s efforts to bridge the planned digital transformation. Referring to the 2020 Corporate Digital Transformation Report published by DSInnovate, the investment approach to the financial ecosystem is one of the strategies that are emphasized to produce what they call “value generation”.

In Indonesia, they operate CVC Mandiri Capital Indonesia, the focus is on investing in various fintech services, both reaching consumers and business people. Other synergy efforts, especially with digital companies, are carried out with an integrated approach through the banking service APIs they provide.

Although the blockchain disruption for the financial industry in Indonesia is yet to be obvious, slowly but surely many people think that the newborn technological innovations could present a new paradigm that disrupts legacy businesses. By entering and integrating with the ecosystem early, it is possible for market leaders to be up to date by synergizing businesses with more relevant technological developments.

–

Original article is in Indonesian, translated by Kristin Siagian