Centaur or aspiring unicorn is commonly used to call startups that have reached valuations of more than $100 million (1.4 trillion Rupiahs) and under $1 billion (14 trillion Rupiahs). One way to measure valuation is based on funding obtained from investors.

The rapid development of the Indonesian ecosystem has brought many startups to the later stage funding – series A round or above. The good implication is, many Indonesian startups have succeeded in holding the centaur degree today.

Without a specific list, according to the Temasek report, Google, and Bain & Company there are more or less 70 centaur startups in Southeast Asia. As for Indonesia, based on research conducted by DSResearch earlier this year, there are at least 27 startups, most of which have been confirmed to have valuations above US$ 100 million.

Listed below the centaur startups:

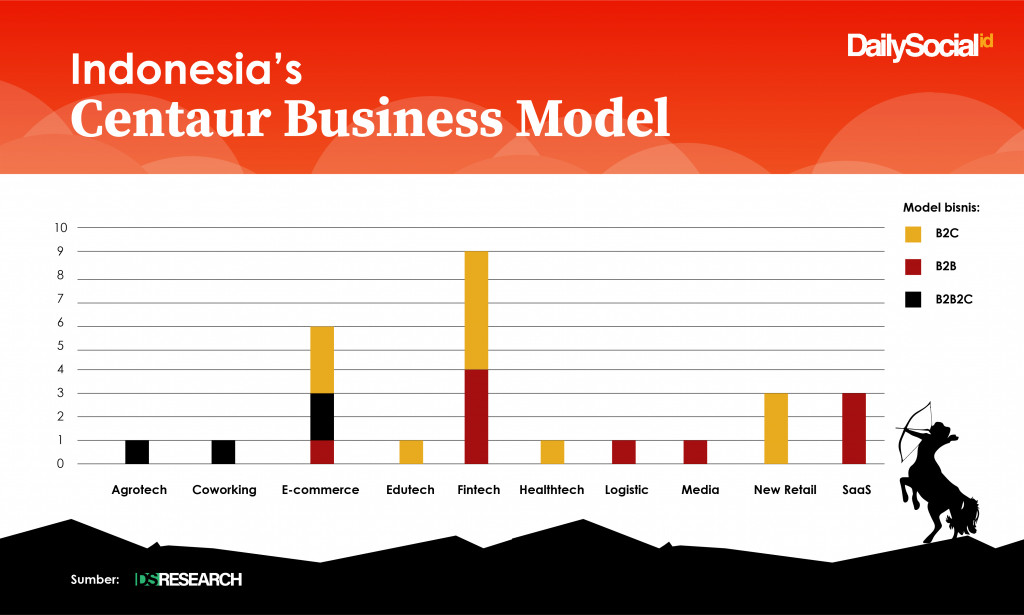

Vertical business analysis

In terms of business verticals, the scope is quite diverse even though it’s dominated by fintech and e-commerce. The trend is quite similar if you look at the list of existing local unicorns, 3 out of 6 players are in the e-commerce sector. Meanwhile, based on the business model a.k.a the revenue streams they relied on, the distribution is quite balanced, there are 13 startups implemented the B2C model, 10 startups in the B2B model, and the rest (4 startups) are targeting both through B2B2C.

In terms of B2B models, there are three fintech lending, two SaaS, and one each for the marketplace, logistics, media, and fintech payment. Although each of them offers services to businesses, some are closely related to transactional businesses at the consumer level.

The p2p lending for example, even though the funds collected from the players distributed to SMEs, their funds are still collected from individual investors. The developed platform is intended for anyone can access the capital flow and act as an investor even though (maybe) it does not provide direct profits because the interest on loans and other costs is charged to the borrowers.

It’s similar to Moka in the SaaS sector. Although the presented features are to embrace micro-businesses, applications, and road services to accommodate the needs of consumer transactions at offline merchants. Its business regulates transactions and cash flow within.

In terms of B2C, it is even clearer because it charges fees to consumers using the products or services. It’s no doubt the buy and sell based business, financial transactions or subscriptions model become the most widely developed.

Market momentum

The fundamental reason that makes successful centaur businesses is market readiness. If only the penetration run in 5 or 10 years ago, the results might not be this significant. Take Payfazz for example, as one of the startups with quite fast business acceleration.

Payfazz application allows partners (the average shop owner) to serve various virtual items sales, such as balance top-up, electricity tokens, insurance payments, money transfers and so on. According to Kemenkopukm, there are around 64 million SMEs in Indonesia with 46.27% engaged in trading, including stall owners. In terms of customer community, the services provided are familiar with daily needs. Economic value is spinning fast in related commodities.

The big pie is now being fought over by other giant digital players, such as e-commerce platforms flocking to strengthen partnership programs with kiosk – Bukalapak, Tokopedia and now Shopee.

Online shopping has become a culture that gives good impact on e-commerce in providing more specific services. For example, what HappyFresh did through the application that allows the public to get guaranteed fresh food. However, the GMV projections for this business will continue to increase to US$ 82 billion by 2025 .

It is very clear on fintech sector, at least 92 million adults in Indonesia are yet to experience financial or banking services (unbankable) will be the potential market.

The right direction

In fact, more startups have been operating for years but yet to reach the centaur valuation. This phenomenon had become a hot conversation, because of the funding gap issue. As the startups that have passed early-stage funding failed to convince later-stage investors.

Furthermore, the numbers presented in the metrics become important for investors. And those numbers will increase sharply whether the business can truly accommodated the necessary stuff for many people, no matter how sophisticated the solutions offered.

The founder intuition to execute the business in the right momentum is one of the keys to the result of 27 startups might soon catch up with their seniors, joining the unicorn line.

–

Original article is in Indonesian, translated by Kristin Siagian