The used car marketplace platform Carro today (15/6) announced Series C funding worth $360 million or equivalent to 5.1 trillion Rupiah. The round was led by SoftBank Vision Fund 2, participated by a number of investors including East Ventures. Carro claims to have reached “unicorn” status with this investment round, aka reaching a valuation of more than $1 billion.

This funding continues the previous ones the company secured for the last few years. In 2020, Carro received debt funding from a number of investors, following the series B round which was closed in the first quarter of 2019. From the seed investment in 2015 until 2020, Carro managed to reach valuation of around $291 million.

The investors involved include Alpha JWC Ventures, B Capital Group, NCore Ventures, Golden Gate Ventures, Endeavor Catalyst, Mitsubishi Corp, and a number of others. SoftBank Group had previously invested in Carro in 2016 through SoftBank Ventures Asia.

Carro is to channel the fresh funds to strengthen its market position and expand its products in the markets of Indonesia, Thailand, Malaysia and Singapore. Carro will also increase its financial services portfolio by expanding beyond in-house loan financing, as well as accelerating the development of AI capabilities.

Last April, Carro Indonesia stated that their services managed to record total sales of used car units of over 100% in Q1 2021 compared to Q4 2020. In terms of business as a whole, Carro claims to have posted revenue growth of more than 2.5x as of March 2021 and continued its positive EBITDA position for the second year in a row.

The next round, based on the founder’s statement to e27, the company is considering to go public. It is said that the plan will be finalized in the next 18-24 months.

Within its company group, Carro also oversees several digital platforms, such as Genie (Singapore), myTukar (Malaysia), and Jualo (Indonesia).

Market Competition

In the category of purchasing (C2B) and selling (B2C) used cars, Carro competes directly with Carsome — both are regional players with business bases in Indonesia and some countries.

The business model is similar, for C2B they buy consumer cars instantly by conducting thorough inspections. The company provides checkpoints at strategic locations — while purchase requests can be made via the website. The purchased cars are then sold to car dealership owners for re-marketing.

As for the B2C model, the cars that were successfully purchased and inspected were re-sold through their digital platform. The unique value offered is the result of inspection, considering that the goods being sold are used stuff. They also work with financial institutions to peddle credit schemes.

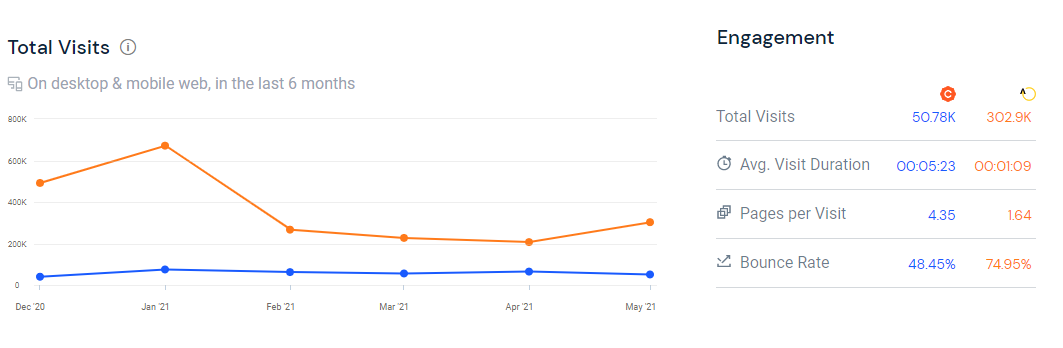

Based on an site visits analysis in Indonesia and Malaysia, Carsome is currently superior to Carro. In each country they operate different sites, such as in Indonesia: Carsome.id and Carro.id; as well as in Malaysia: Carsome.my and myTukar.com.

Carro vs Carsome stats in Indonesia:

myTukar vs Carsome stats in Malaysia:

In terms of funding, Carsome has secured a series D funding round from a number of investors at the end of 2020. From the seed round to the last round, Carsome’s estimated valuation has reached $250 million. Endeavor and the Mitsubishi unit were involved in financing Carsome and Carro.

A recent report published by DealStreetAsia says that Carsome is in the midst of seeking more than $200 million in new funding — and potentially turning them into the next unicorn.

According to company’s submitted data, in Q4 2020 Carsome managed to record the highest revenue, which was double the period before the pandemic. In addition, Carsome also managed to achieve group operational profitability in Q4 2020.

In Indonesia, there are also other players, OLX Autos (formerly BeliMobilGue) which has now been integrated with OLX’s services. The main focus is on buying cars from consumers — although some of the inspection products are currently starting to be sold through OLX and other online marketplace channels.

Carro and Carsome also promote an online-to-offline strategy by presenting outlets to assist the transaction process. Carro just launched the “Carro Automall Point” in April 2021, currently the used car showrooms are located in three areas around Jabodetabek. Meanwhile, Carsome has recently launched the “Experience Center” in early April 2021. For its own inspection points, Carsome has covered 15 cities in Indonesia.

–

Original article is in Indonesian, translated by Kristin Siagian