New Zealand based crypto marketplace platform Easy Crypto announced a series A funding round worth of $12 million or 170 billion Rupiah, led by Nuance Connected Capital involving venture firm GDP Venture that belongs to Djarum Group.

Also, a series of other foreign investors participated in this funding, including pension fund managers Pathfinder KiwiSaver, Icehouse Ventures, Even Capital, Hutt Capital, and Seven Peaks Ventures.

In the official statement, Easy Crypto’s Co-founder & CEO, Janine Grainger said she was targeting the Indonesian and Southeast Asian markets for their next business expansion. This is in line with the involvement of institutional investors believe in the role of crypto assets in the financial ecosystem.

“This capital is an important milestone for Easy Crypto and the future of blockchain in the world. The rising interest in crypto investing is a support for Easy Crypto’s growth on a global scale,” Grainger said.

He claimed, this investment is the largest first round funding the company has ever secured in New Zealand. Prior to this, Easy Crypto had never received investment from angel investors or other investors in the seed stage.

Easy Crypto allows users to trade more than 150 crypto assets. The platform was founded by brothers Janine and Alan Grainger in 2018. To date, Easy Crypto has posted sales of over $750 million with a fivefold increase in the number of users over the past year.

Currently, Easy Crypto only operates in South Africa, Australia, Philippines, New Zealand and Brazil. With the support of venture capitalist GDP Venture, Easy Crypto can push its expansion plans to Indonesia as a top priority.

GDP Venture’s CTO, On Lee said, currently millions of Indonesians already own crypto. The trend of crypto growth in Indonesia will allow Easy Crypto to penetrate with the ease of the buying and selling process.

A bit of information, GDP Venture also has a subsidiary, GDP Labs, which focuses on developing technology products, such as blockchain, cloud computing, mobile computing, big data, and machine learning. This investment enables Easy Crypto synergies with products developed by GDP Labs.

“GDP Venture through GDP Labs has built a blockchain consulting business unit to assist our partners’ blockchain implementation,” he said as contacted by DailySocial.id separately.

Meanwhile, Nuance Connected Capital’s Founding Partner, Adrien Gheur added, the adoption of crypto and blockchain assets is increasing, both in the form of trading, payments, and exchanges. “The number of global crypto users is expected to grow 80% per year in the next three years.”

Crypto’s opportunity in Indonesia

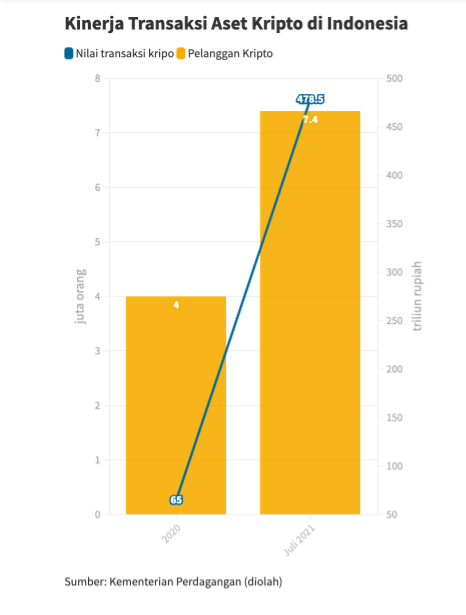

Quoting Katadata, the phenomenon of the growth of crypto asset transactions in Indonesia still continues even though it only contributes 1% to the total global volume of transactions. Based on data from the Ministry of Trade, the value of crypto asset transactions in the country skyrocketed by IDR 478.5 trillion from IDR 65 trillion in 2020.

The number of crypto customers has also reached 7.4 million or doubled from the previous year of 4 million. There are a number of types of crypto assets that have a lot of interest in Indonesia, including Bitcoin, Ethereum, and Cardano.

The growth momentum also led to the presence of new crypto or blockchain startups in Indonesia. A number of investors started to eye this investing sector. In fact, foreign players have begun to penetrate the Indonesian market by seeing the market’s enthusiasm for crypto assets.

Referring to Pitchbook data as reported by CNBC, venture capitalists have disbursed investments of $14 billion or equivalent to Rp202 trillion per Q2 2021. The total investment is said to increase from the same perion last year at $600 million or Rp8.6 trillion.

–

Original article is in Indonesian, translated by Kristin Siagian

![[Paling Kanan] Co-Founder &CEO Dagangan Ryan Manafe / Dagangan](https://hybrid.co.id/wp-content/uploads/2021/10/91b72011d5231d7138dddcae7fa71da2_Paling-Kanan-Co-Founder-CEO-Dagangan-Ryan-Manafe-1.jpeg)